The S&P 500 mini-futures (ESU5) extended Wednesday’s gain yesterday. The futures closed at 2114.75, up 25 points from the previous close (!) on reasonable volume.

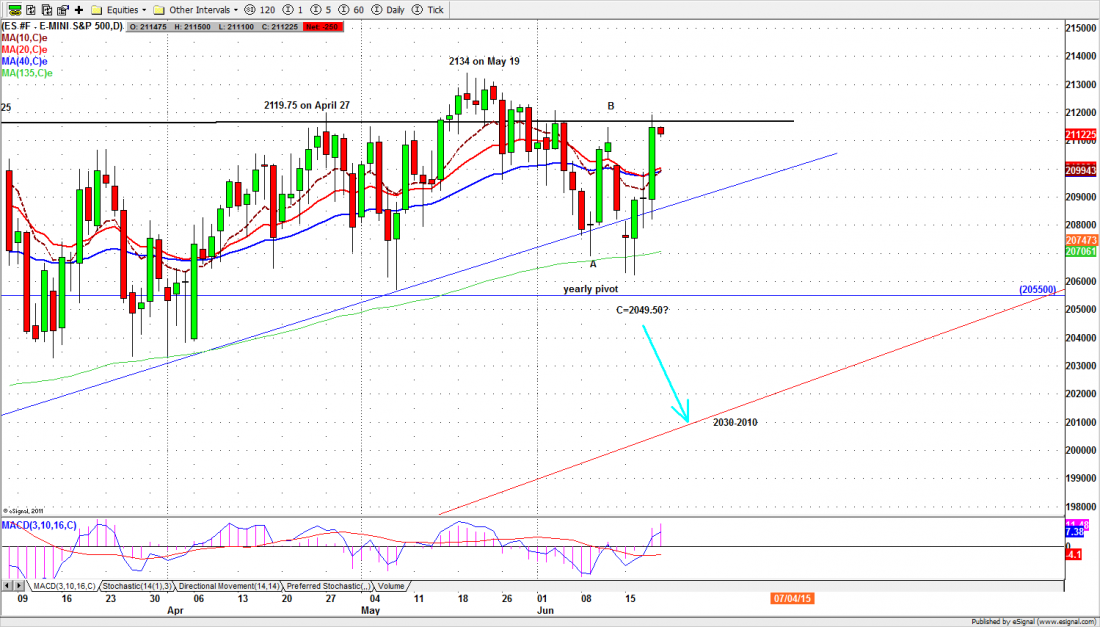

The ES started a dramatic ramp up around 2:00 a.m. eastern time – the small hours of the morning have replaced 3:30 p.m. eastern as the preferred time to start running stops – and continued straight up to the previous resistance around 2115 (see chart) where it stalled for the rest of the day.

There are good reasons to be suspicious about this rally. It comes just before a quadruple witching expiration, which is a time when wide price swings are the norm. And it comes against a backdrop of increasing tension in Europe.

France and Belgium have frozen 50 billon euros of Russian assets to settle an EU-based lawsuit, and the European Central Bank is holding an emergency meeting to discuss cutting or extending the flow of emergency liquidity funding to Greek banks.

The likely result is to accelerate the run on Greek banks, with the possibility they may not re-open on Monday. This would be a good time to make sure you are flat by the end of trading Friday. The weekend may be scary if you have a position open and the market closed.

Today

For the time being the market has established 2062 as the low for the short-term retracement, and it could be the low for the month. There are two possible interpretations of the short-term chart patterns, both with significant inflection points around 2119-2121.

Today (Friday) we’ll be watching the 2119.75-23.50 zone. A move above 2125 will be bullish and the price could be pushed up to 2128.50-30.50 or higher up to 2134-36.50 (short entry for today). Alternatively, by holding under 2119.75 the ES could drop back down near 2100-98.50 for testing.

Based on volume and price action, ES is bullish. But the quadruple witch expiration may be disguising the real move.

Major support levels for Friday: 2062-59.50, 2053-50.50, 2043-42;

major resistance levels: 2123.50-2121.75