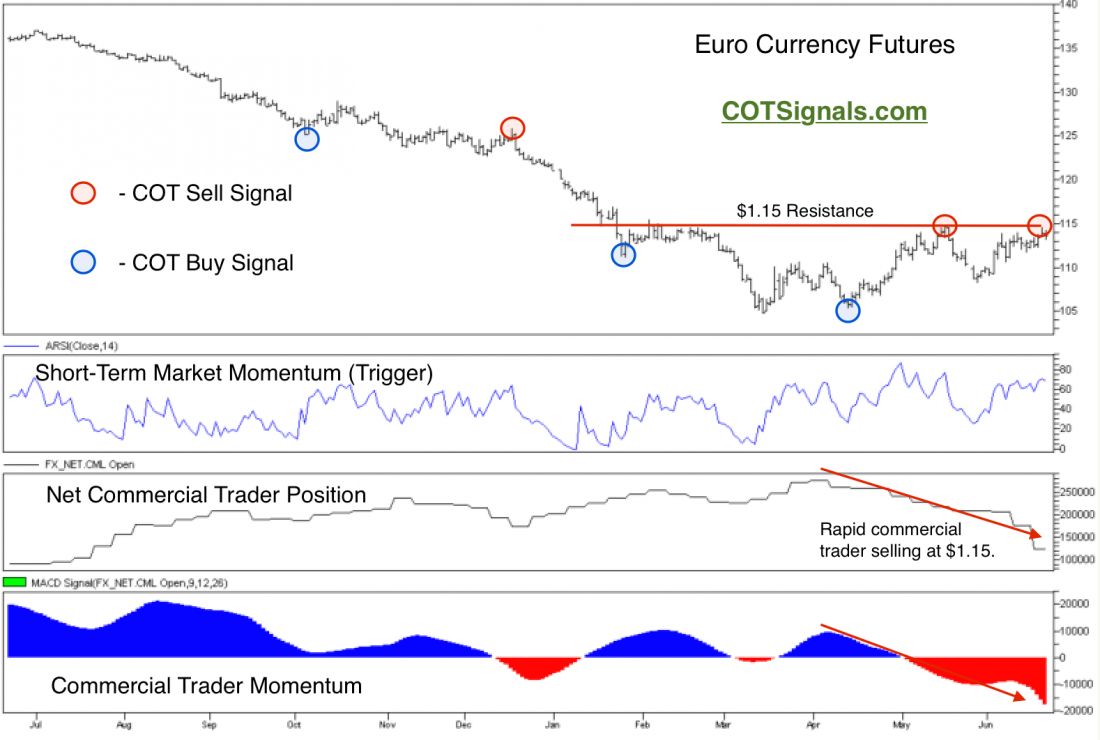

The Euro currency has faced major pressure over the last year as Greece threatens to default in the Mediterranean in addition to the combination of trade sanctions and conflict in the East also contributing to a slowing economy. Meanwhile, the ECB’s Quantitative Easing announcement in January has actually caused the Euro to bottom and rise rather than continuing to weaken in the face of an expanding currency base. We wrote about the coming rally back in April as the commercial traders had built up a record long position. Well, commercial traders have now turned heavily to the sell side as they’ve gotten the market off the lows and it’s nearing staunch overhead resistance in the face of a still deteriorating EU economy.

Looking at the chart below, you can see the record net long position that commercial traders accumulated under $1.10 in April. Given the expected weakness and a bit of profit, we’re now seeing commercial traders bail out ASAP. The Euro currency has moved from $1.08 to $1.15 over the last three weeks. During this time, commercial traders have sold around 84,000 contracts, which cut their net long position by nearly 60%. Furthermore, commercial traders have been net sellers in 10 out of the last 12 weeks. This rapid selling triggered a COT sell signal on May 15th and saw the market fall to the $1.08 level yet again.

Based on the additional selling and the strong overhead resistance, we’ll use Friday’s trade as a reversal and look for the Euro currency to head lower this week. Speculative traders will be scanning the market for bids to unload their late purchases. These late long positions will start to get antsy if the market trades below $1.115 but the real damage won’t unfold until the Euro trades below $1.08.

= = =

Learn more about Waldock and his work here.