The S&P 500 mini-futures (ES) did nothing much yesterday (Tuesday). The market was trying to digest the conflicting rumors and news releases about the alleged solution to the Greek debt crisis, and responded to the confusion by sitting still.

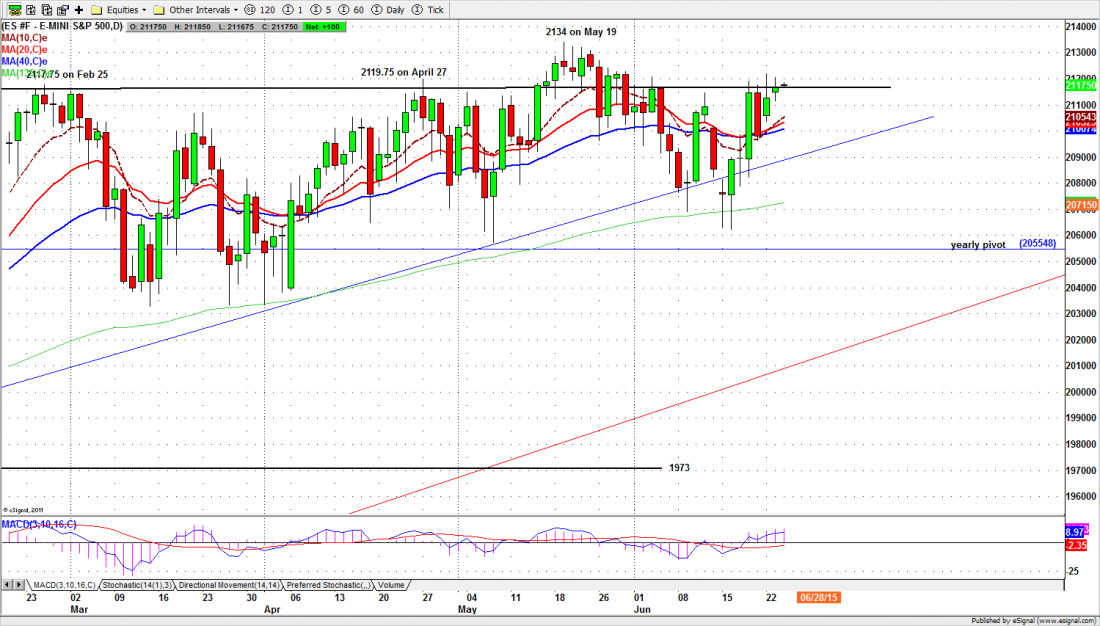

The ES bounced up off what is looking like short-term support just above 2010 and bounced down from the long-term resistance around 2120 to make a narrow range sideways day. It closed at 2116.50, 3.50 points above the previous close. No momentum and it still looks like a top forming.

We think Greece is a distraction; what worries us is China.

Today

The Greek drama is mainly an exercise in extend and pretend but it serves as an excuse to move the market around. The movement in the ES today (Wednesday) will depend on which rumor is given credence.

2122-23.50 is a key zone we need to watch carefully. A move above it could push the price up to 2135-39 to shake out weak shorts. Holding below that zone could lead the price back down to retest 2107-05 or lower toward 2100-95 if the selling is strong.

It could be a whipsaw day with conflicting rumors or a strong trend if there is definitive news. The trading in the first 30 minutes of the day session should tell us the direction.

The major support levels: 2085-88, 2062-59.50, 2053-50.50, 2043-42;

the major resistance levels: 2123.50-2121.75, 2135.50-32.75 and none