Negative headlines out of Greece are weighting on the markets once again and U.S. tech stocks aren’t an exception either. This combined with us being in the historically weak month of June for equities points toward tepid returns in the short-term. Also, we can’t overlook the long awaited return to 2000 bubble levels in the Nasdaq Composite this year and oh, don’t forget Carl Icahn’s recent bearish call for a correction in the market.

Keep in mind the analysis below shows the short-term setup in the market, but long-term bull market trends remain intact.

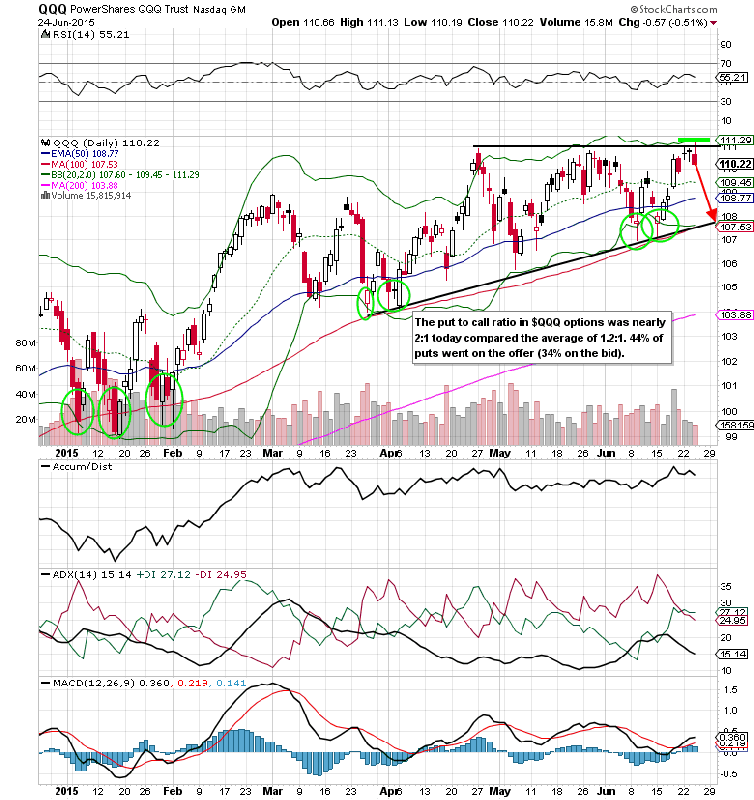

The Nasdaq ETF hasn’t had any luck at the $111 level over the past two months and the daily chart above shows just that. Shares of the QQQ’s printed a bearish hammer candlestick on June 24th, closing nearly $1 off of the highs. This type of price action at resistance sets up for a low risk shorting opportunity, using a buy stop loss reference above $111.13. Look for a move down to around $108 at a minimum (major support at the 100-day simple moving average).

If you’d prefer to use options instead of an outright short, I’d looked at weeklies 2 expirations out in time. You can play this by buying July 10 weekly puts or selling bear call spreads for a more conservative trade. The $111.13 level in the ETF can still be used as a reference point for a stop loss.