Time for us to brag a little. Earlier this week we cast doubt on the breathlessly-announced Greek debt deal, and predicted a decline in the S&P 500 mini-futures, the ES. Yesterday (Thursday) it all worked out pretty much as we expected.

The alleged deal has disappeared, the euro summit that was supposed to ratify it has been cancelled, and the negotiators are working under stern instructions to get it done before the markets open Monday. Monday may see an announcement from both sides declaring mutual success, but you believe it at your peril. A deal may be possible; but the fundamental problem will remain.

That’s what the ES is showing. It closed yesterday at 2094, down 5.50 from the previous day, and 26 points below the giddy high on Tuesday, when everybody promised the deal Greek deal was done.

It is; done like dinner.

Today

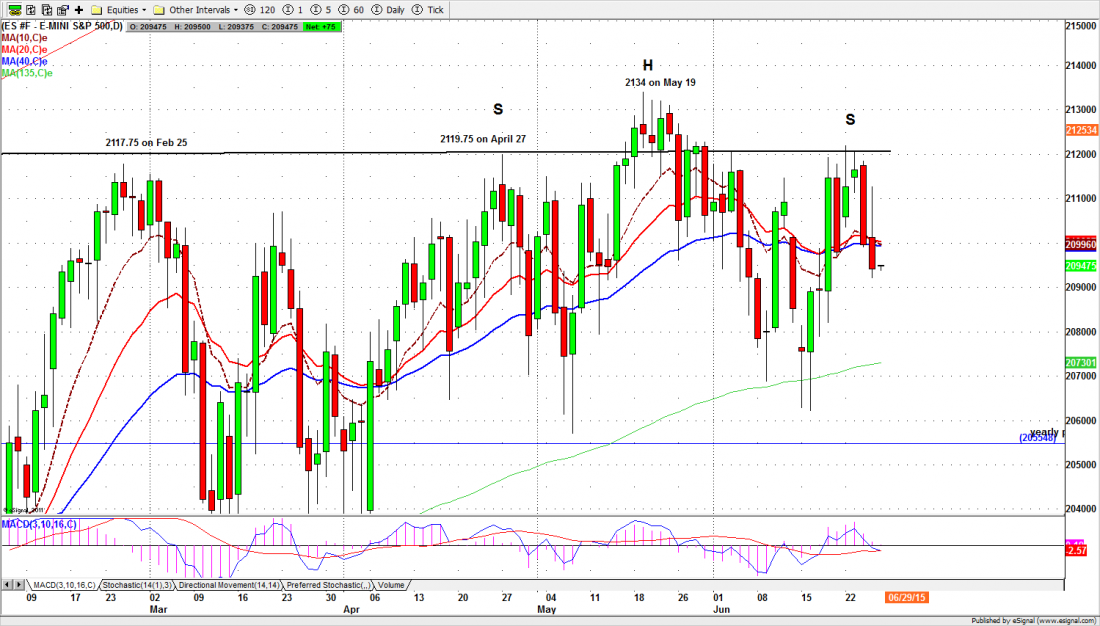

From a technical perspective, a potential double bottom bullish pattern failed this week, and instead we are looking at an intermediate-term bearish H&S pattern (see chart). As long as ES doesn’t close above 2100, the short-term trend should be down and toward the 135-day moving average line.

Today (Friday) ES may drop further toward the unfilled gap at 2089.25 in the early session or lower to the 2080-75 area. If ES does go this way, we should later expect a bounce from that low.

2098-2100 is the first resistance zone. The price may fake a move higher to run stops, but our traders will still focus on the short side.

The major support levels for Friday: 2085-88, 2070-80.50, 2062-59.50, 2053-50.50, 2043-42;

major resistance levels: 2112.50-14.50, 2123.50-2121.75, 2135.50-32.75