Last night, while most of us were watching TV, feeding the cat, or raiding the refrigerator, the S&P500 mini-futures (ESU5) dropped 40 points in a matter of minutes. If you held a position open on Friday afternoon at 4:15, it was worth $2,000 less per contract on Sunday at 6:30 p.m.

And there wasn’t anything you could do about it. The loss occurred while the market was closed for the weekend. By the time the overnight market re-opened the damage was done and you were considerably poorer.

And today might be worse. The New York stock market itself – in contrast to the overnight futures market – doesn’t open until 9:30 Eastern Standard Time. By the time you read this, the losses may be much worse.

Or not. There will be strenuous efforts to contain the damage, and they may succeed.

The cause of all the blood in the Street is the Greek debt crisis, which finally blew up over the weekend. The Greek government refused to accept the “final offer’ from its creditors, and called a referendum on the proposed deal, to be held a week from now, on July 5.

The referendum is likely to be a prelude to a default. The Eurozone finance ministers refused to extend any further emergency liquidity assistance to Greek banks, effectively putting the Greek banking system into crisis. Monday morning the Greek banks will be closed, as will the Greek stock market, probably for all of this week. Capital controls have been imposed to keep money from leaving th country and prevent a run on the banks.

Oh, and this morning Greece will almost certainly default on a $1.72 billion payment it owes the International Monetary Fund.

It was only last weekend we were treated to glowing commentary promising that a Greek deal is all but certain. This weekend it is a wasteland. And there are only four trading days this week to fix it.

What happens next

This may be the start of something big, as Sinatra once sang, but it probably isn’t The Big One that has been predicted so freely. There’s lots of fear, but we didn’t find any panic. We were trying to sell Puts (which would pay the buyer if the market drops further) on the ESU5 last night at the lowest point in the decline, and couldn’t find buyers.

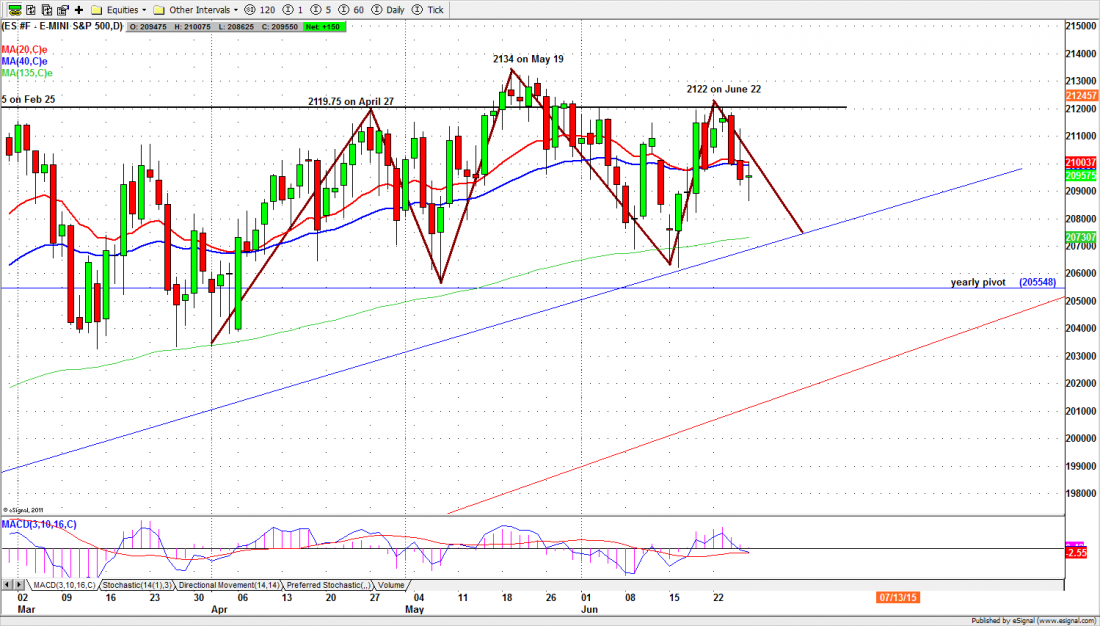

We’re technicians, and it is significant to us that the decline stopped at the yearly pivot point (2055) and rebounded.

And while we expect extreme turbulence in the markets for a couple of days, we believe the most likely outcome will be a flight to safety by panicked overseas traders who will want to get as far as possible from the Greek “contagion.”

We think that means a bump in US equities, maybe a bump in Gold, and a flight out of the Euro and into the US dollar.

We have been expected a consolidation, and perhaps a correction, in US equities for the past month. The current crisis in Greece is certainly bad news for the Greeks, and somewhat bad news for Europe. But it ain’t the crash of 2008 and Lehman Brothers all over again. It is a blip, in what we still believe is a continuing Bull market.

The major support levels for Monday: 2070.50-68.50, 2064-62.50, 2053.50-50.50;

major resistance levels: 2107-08.50, 2122-25, 2134-36.50 and none

To get more actionable analysis of US equity markets from Naturus.com follow this link

Chart: ESU5 daily chart, June 26, 2015