One of the much talked about but yet to materialize issues regarding the last 6-7 years of economics has been, “At what point will precious metals receive a boost due to inflation?” In spite of Milton Friedman’s inflation being, “always and everywhere,” it has yet to gain any real traction. Yet, in spite of or, perhaps because of, we’ve seen speculative interest in the precious metals wane as a humdrum reality continues to imply neither the disaster of fiat currencies nor the hyperinflation that’s been written about ad nausea in the age of Zero Interest Rate Policies (ZIRP). However, what if the speculators have given up at exactly the wrong time?

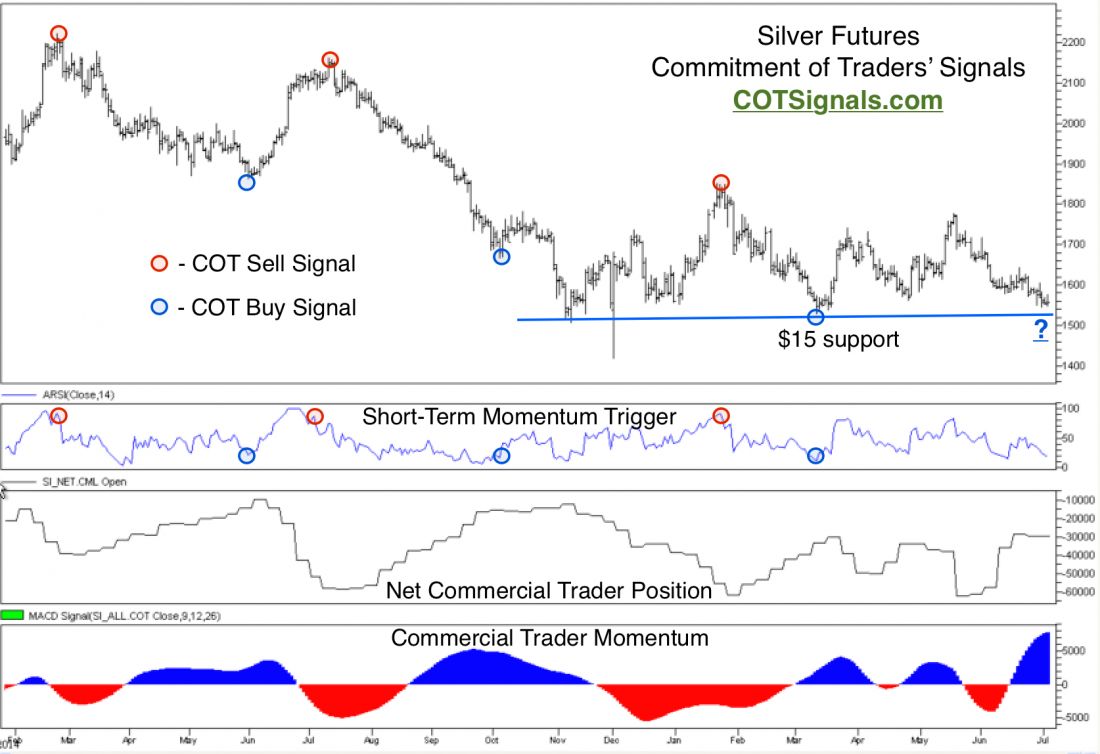

The silver futures market has bounced along the $15 support area for the last seven months or, so. During this period, we’ve seen large changes in positions among the market’s participants. We focus on the balance of the market’s participants based on the weekly Commitment of Traders Reports in order to determine who is doing the buying and selling. We want to be on the side of the commercial traders. You can see their actions in the silver futures market in the third pane of the enclosed chart.

Silver has been in a downward trend since 2011. Commercial traders are value traders who employ a mean reversion trading strategy. They buy or sell when the market is under or overvalued, respectively and offset their positions as the market returns to its value area. These actions can be clearly seen as they build up positions as the market approaches $15 and immediately lay them off as the market bounces back towards $17+. Conversely, each of the three times the market strengthened sufficiently, commercial traders were there to rapidly cap the rally.

The current setup provides a potential buying opportunity. Commercial trader momentum is positive due to the 32,000 contracts they’ve purchased in the last four weeks. The market’s recent weakness has created a short-term oversold condition due to small speculators’ long liquidation. This combination leaves the silver futures primed for a not only a short covering rally but, also may have some reasonable legs as we’ve not seen the commercial traders take anything less than a couple of dollars out of this market when they’ve been buying assertively.