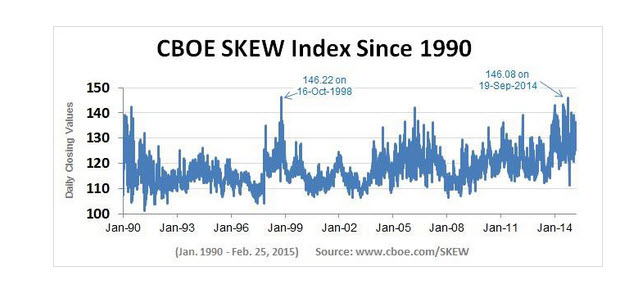

The skew index was created by the CBOE after a fascination with volatile markets in the 1987 crash. The thought was how it can capture where bets are being placed before a big market event, usually a dive. The skew index captures tail risk, a two or more standard deviation event that is simply outlier risk.

We often see these bets being made when volatility or the VIX is quite low. Just last week we saw a massive drop, on June 29 after the Greece debacle started. That was a 2% drop on that particular day, but could that have been forewarned. I believe so, as the VIX the prior week clocked in at 12%, while skew was at 125. Players were reaching for protection as it was inexpensive. That paid off.

In 2014 we saw some of the highest readings ever in skew, many were in the top 10 all time. On Sept 19 of that year, the day Alibaba was released we saw the second highest reading ever, the VIX down near 11%. What happened next? You guessed it: a nasty 9.5% SPX decline.

What to do? Pay attention to the CBOE Skew Index seen here from time to time, and when it rises to higher levels congruent with a low VIX, then buy some protection. Especially when it’s not in vogue. You’ll be happy you did.