There’s been a lot of attention paid to the growing speculative short position building in the gold futures market. We’ll look into the Commodity Futures Trading Commission’s (CFTC) Commitment of Traders (COT) report and some of the calculating issues that must be accounted for as well as a graphic representation of how to use both the small speculators and commercial traders to your own advantage when trading the metals markets.

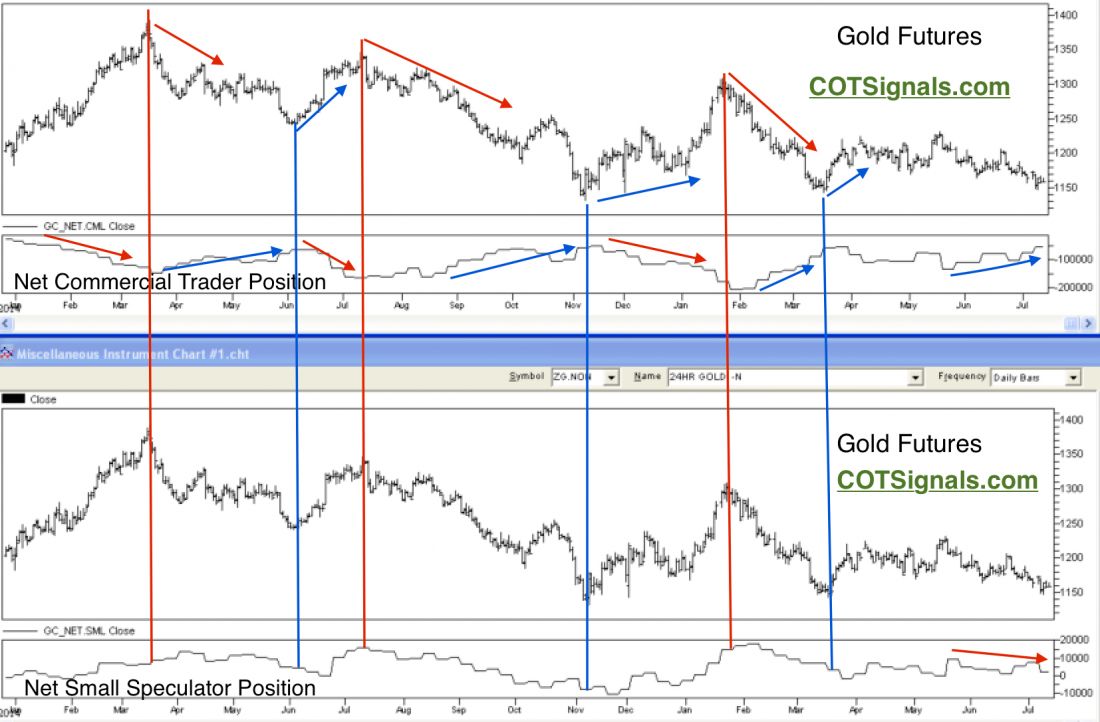

First of all, we track the net position of both the small speculators and the commercial traders. The COT report is broken down into total longs and total shorts. The point being that a record speculative short position in nominal terms may be partially balanced by a large speculative long position thus, creating a far more neutral, net position. The same can be said for any of the other trader categories as well. The net trader position for both the commercial trader and small speculators are, respectively plotted below the underlying gold market’s price movements.

Each vertical line in the charts represents a recent significant turn in the market. Each of these turns has been preceded by consistent behavior in both the commercial and small speculator trader categories. Very simply, following the commercial trader category places the trader in the position of buying the market’s declines and selling the market’s rallies. Commercial traders are by nature, value traders. As the market they trade becomes over or, undervalued they step in taking the opposing action as their expectations are based on the market’s return to value.

This is mean reversion trading.

Small speculators on the other hand, can be seen buying every rally and selling every decline. This is a breakout trading mindset based on Newton’s first law of motion. Once a market begins moving in a given direction, it will continue to do so, unless acted upon by an outside force. Small speculators are looking for trend trades while the commercial traders are exactly Newton’s, “outside force” in a range bound market. Clearly, the commercial traders have had the upper hand in the gold futures market over the last 18 months.

This brings us back to the current situation where the divergent behavior between the commercial traders and the small speculators has caused our interest to pique. Commercial traders have built up their largest net long position since last November. Putting the commercial buyers’ pockets behind a long gold trade at these levels could prove to be fruitful going forward as their buying has stemmed each of the recent declines to the $1,140 per ounce area. Whether this works as a spike lower followed by a sharp reversal higher as the short side gets sold out or, whether the market simply grinds higher, the commercial traders have telegraphed their anticipated direction and their success speaks for itself.

Learn more about Waldock’s work here.