With so much uncertainty over recent events in Greece and China it’s no wonder markets have seen a sharp rise in volatility. As measured by the VIX, we saw volatility rise nearly 80% in just better than two weeks, vaulting from about 12% to 20% during that time. Uncertainty creates doubt, and as long as this bull market has been in place there is not one investor/trader out there who wonders when it may end or a deeper correction would ensue. But like Pavlov’s dog, investors are hungry for return and when days like Friday happen (huge market rally) the saliva glands start working again.

But after several days of higher volatility, is this just a blip on the screen as we’ve seen during previous pullbacks or something more of a concern to the bulls? As a follower of trends and patterns I have to follow the previous moves as my guide unless the pattern changes. As we can see from the VIX chart the recent pop in volatility has been around here for a couple of weeks. The range of volatility spurted higher on news about Greece and then sudden changes in China investment policies to help curb a massive slide. In addition, we learned Puerto Rico was facing a major debt repayment situation.

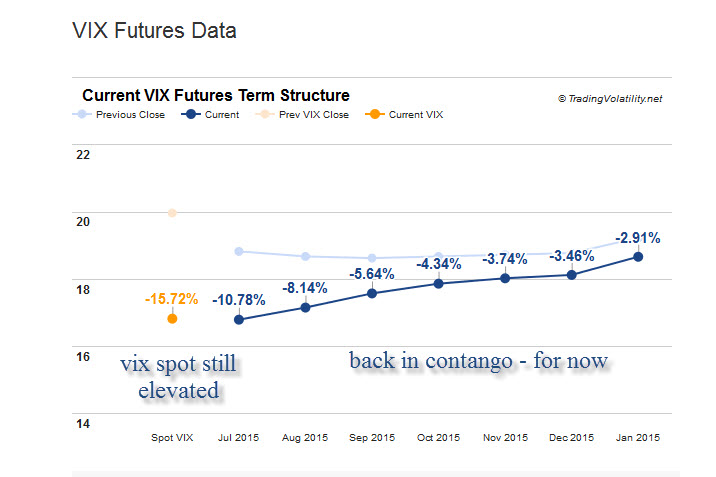

The volatility futures curve also shows a rise in fear and concern, the term structure elevated while spot VIX is also above recent levels. Friday saw a steepening of the curve which was bullish for stocks, but as always we need to see some follow-through. If that happens this week the gap we see in the VIX chart will fill and we would likely see the SPX 500 back up toward the 2100 level.

As I spoke about on the webinar last week, the most reliable moves are reactionary and not anticipatory. Trying to guess is just a fool’s game, and while we all have to estimate in some way how our ideas will play out, when trends are obvious it makes sense to ride them out. Take June 29, following the Sunday when it appears no deal with the Euros and Greece would happen. Futures that night tanked hard, but then we saw the following day gap down with no bid in the market. That led to a massive trend down day, SPX 500 closed down 2% on heavy turnover.

This was a reactionary response, and it paid off. VIX futures went up sharply as expected and started to flash danger signs. That worry flag signaled complacency, which always gets smacked down when volatility is too low (isn’t there always something to worry about?).

Yet this past Thursday saw the markets gap higher and lose the rally the entire day. We saw many positioning for the inevitable – anticipating a follow-through to the downside and a sharp decline to come. Bets were made on this outcome, which proved to be quite incorrect. Waiting for the move to happen rather than guessing is always the safest approach.