In this news-driven environment, gaps are Us.

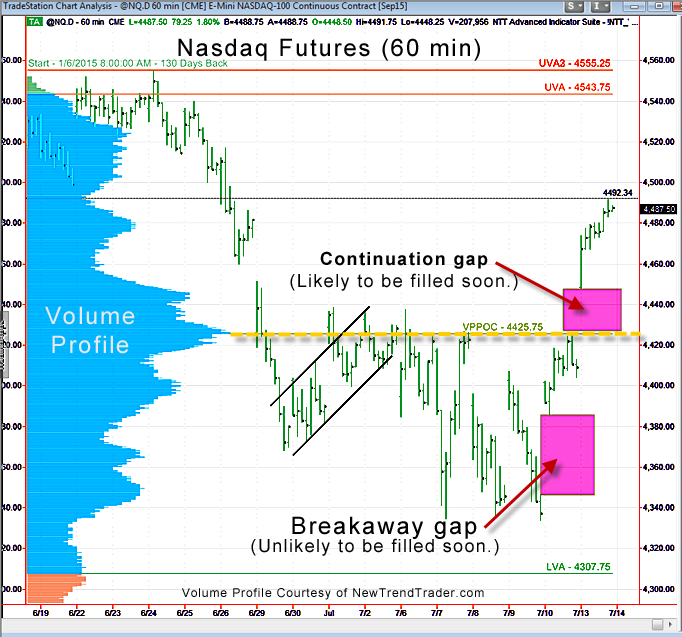

We did fill the 4410-4418 gap on Friday morning, as expected, but the interesting thing about that day is that the Sunday night rally created what is likely to be a ‘breakaway gap.” This is a gap that occurs in an oversold condition and can take months or even years to fill. (See chart)

As expected, the market on Friday stalled at the very robust Volume Profile Point of Control (VPPOC) at 4425. On Monday, however, a nearly 2% surge in the Nasdaq futures left yet another gap right at the VPPOC. This is a much more likely target for some quick backing and filling.

Overall, the market is acting well. After an orderly 10-day decline, the small caps bounced nicely off their uptrend channel on Monday. Meanwhile, the heady Biotech index (IBB) appears ready to post a new all-time high.

Apparently, all’s right with the Bull.

A Note on Volume Profile

The histogram on the left side of the chart shows the volume distribution in the Nasdaq futures for different periods of time. Key support and resistance levels are indicated by the peaks and troughs. If you would like to receive a primer on using Volume Profile, please click here