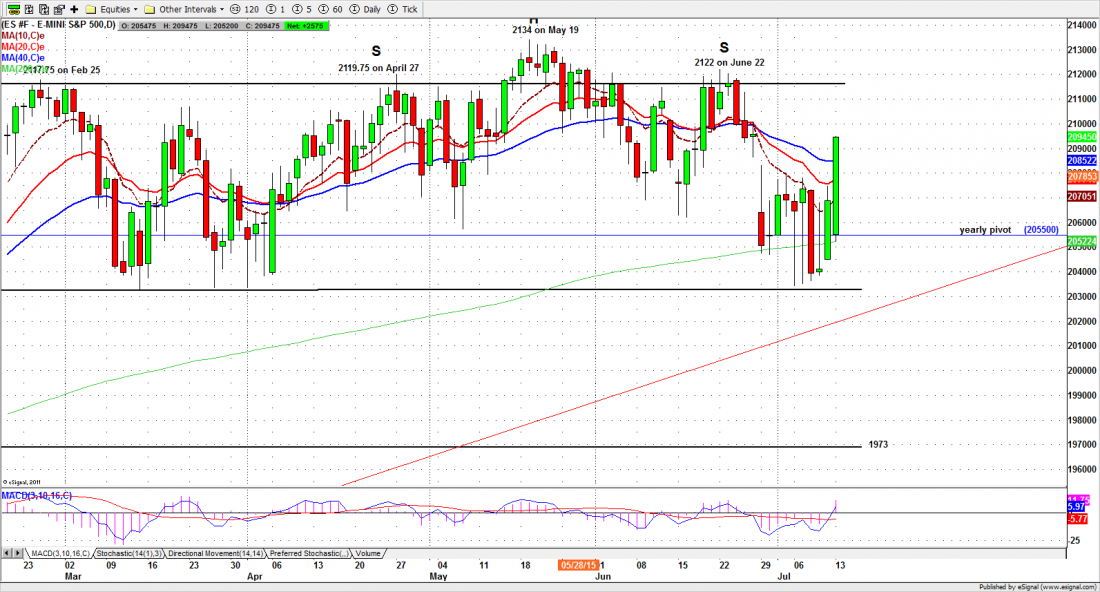

More Greece, more whipsaws. The S&P 500 mini-futures (ES) – the major trading vehicle for European traders trying to participate in US equity stock markets when the NYSE is closed – gapped down 20 points in the early hours Monday when it looked like No Deal for Greece. Then it ran up 40 points on the news that there is (or may be) a deal after all.

The futures finally closed at 2094 Monday afternoon, a couple of ticks below the unfilled gap we identified as the upside target, and fully 30 points above the previous close. The volume was weak, but the ES closed above all its daily momentum resistance levels.

Now the 2050 level returns as the major short-term support level. As long as ES stays above it, the odds favor the upside. We expect the ES will challenge the psychological resistance level at 2100 and perhaps move past it… unless/until we get the news that the deal is off.

A lot can go wrong with this agreement – it is actually worse the proposal that was defeated in a referendum eight days ago – and even if it ever become reality it doesn’t change much. It just kicks the can down the road for a little while. The underlying problems remain unresolved.

Today

Today we may see a continuation high move after a brief early pullback. 2082-84 will be the first support and 2070-68 will be the next support below it. 2104-05 will be first resistance. If ES goes up first, it could reverse from the first resistance level to yesterday’s low for testing. But if ES goes down first, the price could move back up as soon as it finds support. We will continue to see “Buy the Dip” moves.

Major support levels for Tuesday: 2054-52, 2038-39, 2028-30;

major resistance levels: 2093.75-95.50, 2108-12.50, 2118.50-21.75

For more detailed market analysis from Naturus.com, free of charge, follow this link