Since the beginning of the month some prominent weather sites particularly WX Risk have been seeing signals that a shift to a warmer and drier pattern could be in store for the majority of the major grain growing areas of the Midwest. There have been hints of this showing up on the weather models last week but the data over this past weekend through July 14th provides stronger evidence. The model shows it drier in all key areas as the trend is continuing as we move into 2nd half of July. For the next seven days forecasts call for good rains of 1-3″ over North Dakota, Minnesota, and Wisconsin with 70% coverage and 0.50-1.50 inches over Michigan, eastern Indiana, Ohio, and eastern Kentucky. The rest of ECB is dry as are most of WCB and all of Delta and all of the Plains. In addition temperatures finally turn warmer east of Mississippi river.

Although it is a commonly held belief that El Nino Summers in the U.S. always bring above normal rainfall and very little with respect to sustained heat over the Midwest, it is not necessarily the case. El Nino Summers which featured significant or rapid development of the El Nino phenomenon in May and June sometimes develop a different type of weather pattern for the second half the summer.

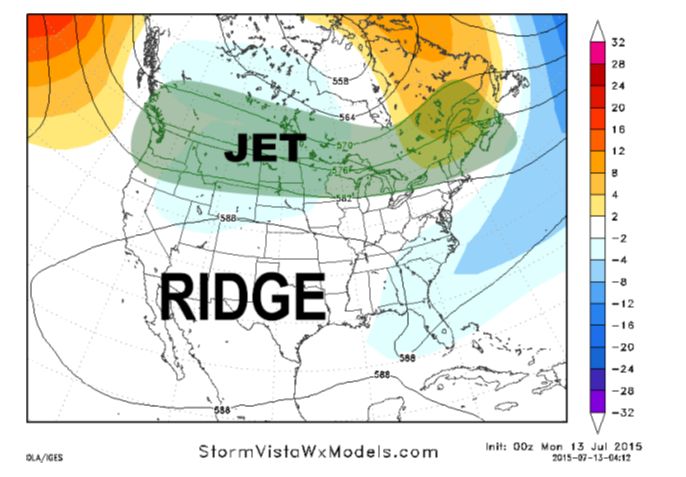

We are beginning to see strong signs of this on the various weather models. The image below shows the Jet stream pattern for July 21st through the remainder of the month. The key point here is to realize that the Jet stream is finally shifting to the north along the US Canada border. This is one of reasons why south central Canada likely turns wet in this timeframe – as well as North Dakota and Minnesota But all areas to the south seems to turn significantly drier.

Note that weather and its impact on future yields is 90 percent of our pricing influence on grains. If the weather forecast continues to shift towards a warmer and drier outlook, the grain market could see a slowdown in buying support, and perhaps a correction. Therefore I propose a futures spread to take an advantage of a potential correction. For some bearish exposure in the soybean market one could short the November 2015 contract while buying the November 2016 contract initiating a futures spread. I would suggest selling at 56 cents; selling the November 15/November 16 soybean futures spread with a profit objective target at the 50 percent retracement level at 29.4. Protective stop losses should be placed at the highs above 73.2. If filled the risks are the commissions and fees along with the Good to Cancel stop loss at approximately at least 17.4 cents.

For those interested in grains, Walsh Trading’s Senior Grain analyst Tim Hannagan hosts a free grain webinar each Thursday at 3:00 pm central time. Tim has been ranked the #1 grain analyst in the United States per Reuters and Bloomberg for his most accurate price predictions for soybeans and corn in the years 2011 and 2012. Link for next week’s webinar is below. If you cannot attend live, a recording will be sent to your email upon signup. Sign UP Now

RISK DISCLOSURE: THERE IS A SUBSTANTIAL RISK OF LOSS IN FUTURES AND OPTIONS TRADING. THIS REPORT IS A SOLICITATION FOR ENTERING A DERIVATIVES TRANSACTION AND ALL TRANSACTIONS INCLUDE A SUBSTANTIAL RISK OF LOSS. THE USE OF A STOP-LOSS ORDER MAY NOT NECESSARILY LIMIT YOUR LOSS TO THE INTENDED AMOUNT. WHILE CURRENT EVENTS, MARKET ANNOUNCEMENTS AND SEASONAL FACTORS ARE TYPICALLY BUILT INTO FUTURES PRICES, A MOVEMENT IN THE CASH MARKET WOULD NOT NECESSARILY MOVE IN TANDEM WITH THE RELATED FUTURES AND OPTIONS CONTRACTS.