Traders who are relatively new to the futures market often get fooled by the persistent mean reversion behavior. For example, breakouts are more often faded than endorsed. This antagonistic approach to new highs and new lows flies in the face of what many equity traders experience and expect in the high momentum stocks they like to trade.

The futures market is quite different than the equity market. Not only are futures the home of large hedgers, but the increased leverage in these markets rewards gamesmanship and makes the virtual futures ‘pit’ more like a Roman coliseum.

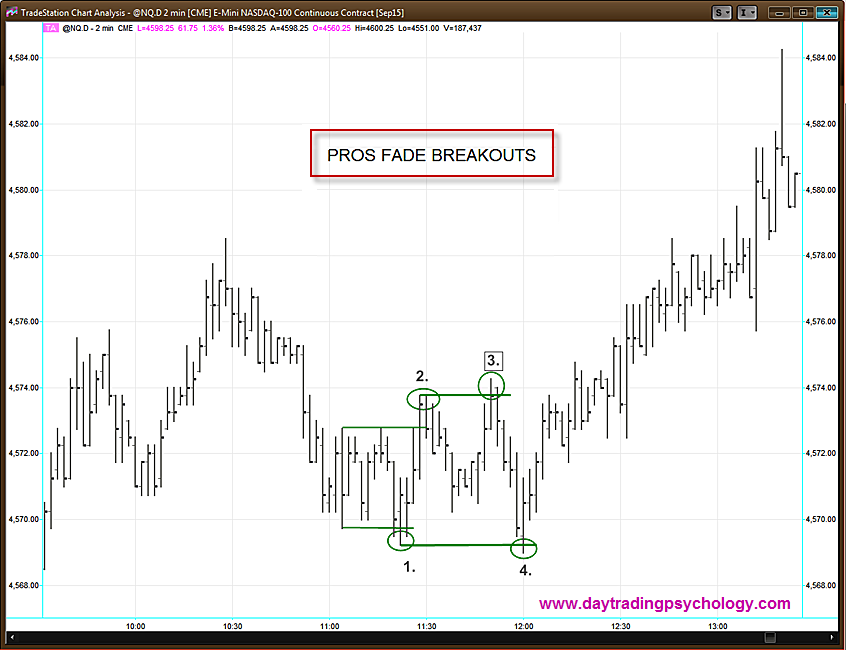

This is a 2-minute chart of the Nasdaq futures on Thursday 7/16. (The time axis is Mountain Time.) The market gapped up about 23 points at the open, continued to rally into lunch and then began a mid-day correction. There’s a common rule of thumb from the equity world that advises to “sell short when the market breaks a pivot low.” Sometimes this works.

Other times, especially in the futures markets, it gets one trapped almost immediately on the wrong side of a reversion move. Points 1, 2, 3 and 4 are examples of places where breakout traders would need to change their minds quite quickly. Getting caught on the wrong side of this mean reversion game can be very expensive. Of course, mean reversion traders themselves get punished during strong trends such as we have had this last week.

Bottom line, aspiring futures traders need to learn both trading skills to succeed in the modern market environment.

To schedule a free 15-minute consultation about how to improve your trading click here