Before the market opens on Wednesday, July 22, healthy pet product maker Blue Buffalo Pet Products’ (BUFF) 29.5 million share IPO is expected to price within a range of $16-$18. The lead underwriters on the deal are JP Morgan and Citigroup. BUFF’s IPO comes on the heels of another healthy pet food IPO, Freshpet (FRPT), which went public on November 7, 2014. Taking a look back on how that IPO fared, its’ 10.4 million share IPO priced at $15, above the $12-$14 range, but then slid lower over the first few months of trading. However, the stock has been strong of late, up about 25% since July 6, which may be a good omen for BUFF’s upcoming IPO.

A Closer Look at BUFF

BUFF says it is the fastest growing major pet food company in the U.S., selling dog and cat food made with whole meats, fruits and vegetables, and other high-quality, natural ingredients. It has approximately 6% share of the overall pet food industry and feed only 2-3% of the 164 million pets in the United States.

It develops, produces, markets and sells pet food under its four major product lines: BLUE Life Protection Formula, BLUE Wilderness, BLUE Basics and BLUE Freedom. Each line of pet food includes different product types for dogs and cats, such as dry food, wet food and treats. It also produces and sells cat litter products under the BLUE Naturally Fresh line.

It sells its products in the specialty channels, either directly to retailers or through distributors. The specialty channels include national pet superstore chains, regional pet store chains, neighborhood pet stores, veterinary clinics, farm and feed stores, eCommerce retailers, military outlets and hardware stores.

Its products were first sold in national pet superstores and a significant majority of its net sales is still generated from national pet superstores, PetSmart and Petco, which are its top two customers. Over the last three years, it has continued to diversify its customer base, with 74% of its net sales generated from national pet superstores in 2014 as compared to 78% in 2012.

The primary market for its products is the United States, which represented approximately 96% of its net sales in 2012 and 97% of its net sales in each of 2013, 2014 and the three months ended March 31, 2015, with the remaining 4% and 3%, respectively, for each of those periods attributable primarily to its operations in Canada, where it also markets and sells its products.

Financial Review

The primary market for its products is the United States, which represented approximately 96% of its net sales in 2012 and 97% of its net sales in each of 2013, 2014 and the three months ended March 31, 2015, with the remaining 4% and 3%, respectively, for each of those periods attributable primarily to its operations in Canada, where it also markets and sells its products.

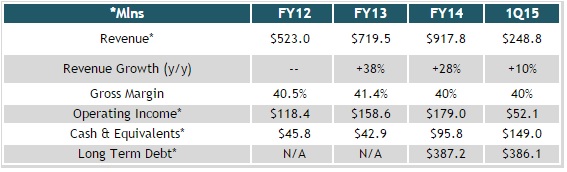

Gross profit increased $3.2 million, or 3.3%, to $99.5 million for the three months ended March 31, 2015, compared to $96.3 million for the three months ended March 31, 2014, driven primarily by increased volume. Gross margin decreased to 40.0% for the three months ended March 31, 2015, from 42.6% for the three months ended March 31, 2014 and was primarily impacted by incremental supply chain costs (1.1 percentage points gross margin decrease), Heartland start-up costs (0.7 percentage point gross margin decrease) and lower net price realization (0.7 percentage point gross margin decrease).

Operating income fell 3% y/y to $53.6 million and adjusted net income dropped 3.5% to $31.2 million.

Conclusion

All in all, while I’m not necessarily pounding the table on BUFF, it does look like a pretty solid IPO. Revenue growth has been solid, although it did taper off in 1Q15. Gross margin has held firm over the past few years and the company is comfortably profitable with operating income expanding.

Also, with a trailing P/S of about 4x FY14, its’ valuation looks quite reasonable for a profitable company growing the topline by double digits.

One blemish that sticks out is the mountain of debt on its books. However, this concern is mitigated by its solid cash flow generation — $90.1 million in FY14.

Wrapping up, BUFF is an IPO I have a bullish stance on due to its strong overall fundamental picture. But, its’ declining topline growth rates somewhat lessen my enthusiasm on it.