Several of the stock market heavyweights reported Q2 earnings yesterday (notably IBM and United Technologies Corp UTX) and the results were not pleasing. The DJIA was red all day long, and dropped 181.12 points at the close. The S&P 500 and the mini-futures (ES) both caught the contagion and ended lower. The mini futures (ESU5) closed the day at 2114.50, 4.25 points below the previous close.

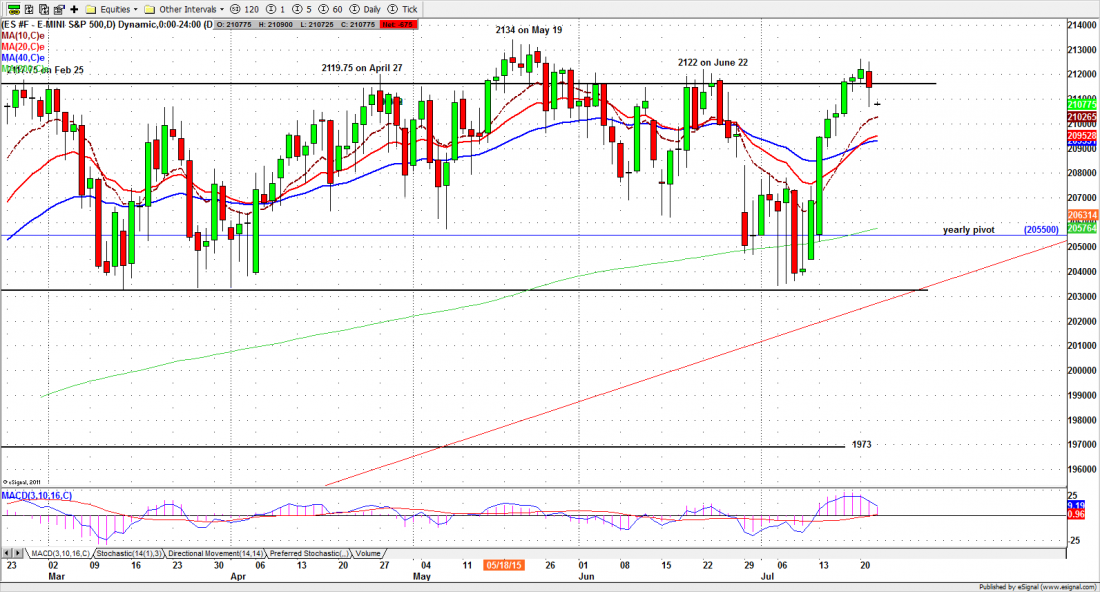

We don’t find that minor pullback surprising. The futures have been up for eight days, and were substantially over-bought. The rally was too fast and too steep, and it brought the price back up to the upper band of a well-defined sideways range that has contained the price for several months (see chart). Buyers were reluctant to place new orders at that level, at least for the time being, because everybody expected at least a little pause. The pullback we’re seeing now – and which was continuing in the early overnight trading – should be treated as normal market behavior.

Today

The key area to watch today is 2100-2095. This is an important support area, and it needs to hold to allow the rally to continue, and eventually challenge the main resistance at 2125-2135.

In the early morning sessions we may see a continuation low move if the price stays below 2114.50 during overnight trading. In the later session the ES may reverse and rally again if the support at 2095 holds, and the price moves back above 2100.

Alternatively, the ES may break below the 2095 line and trade into the 2090-88.50 zone. If that happens it still won’t be much cause for concern… unless the futures close below 2095. A close below the support would make us re-evaluate the rally.

Major support levels for Wednesday: 2106-03.25, 2095-95.50, 2085-88.75, 2062-64, 2054-52;

major resistance levels: 2128.50-29.50, 2134.50-36.50 and none

For more detailed market analysis from Naturus.com, free of charge, follow this link

Chart: S&P500 mini-futures (ESU5) July 21, 2015