“Ask Kase” and your question may be chosen as the subject of a future column (askkase@kaseco.com).

With the first increases in interest rates in over nine years looming, and the dollar strong, and gold supplies reportedly healthy, especially in China, it’s looking especially weak. After a strong decline on Monday, it bounced a bit on Tuesday, so, is it time to “go for the gold”. While fundamental pundits are hazy, technicals can polish up the outlook.

The current spot low is $1072.45 as shown on the daily chart below. This price constitutes the “equal to” extension of the wave down from $1307.41, and thus is strong support. The big down day on Monday was followed by a star Tuesday, which is bullish. Daily momentum is oversold, but mitigated somewhat by the lack of divergence, a turn signal.

XAUUSD Daily Chart with Equal Waves, Harami Star, and Oversold Stochastic

Charts created using TradeStation. ©TradeStation Technologies, Inc. 2001-2015. All rights reserved. No investment or trading advice, recommendation or opinions are being given or intended.

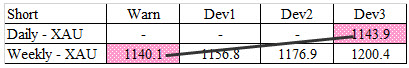

The major line of resistance is a confluent $1145, the equal extension for the bounce up from $1072.45, and the trend terminus, 2*1.38, and Phi3 corrective projection for the last reaction wave, $1094.35 – 1109.8 – 1098.26. $1145 is the Kase DevStop3 on the daily chart and warning line on the weekly. Whenever there’s such correspondence, the confluent value increases in importance. $1145’s also the 10 day and four week moving average. So $1145 is unlikely to be overcome without a significant clarification from outside influences. If and when this happens though, the next big target is $1222, then next key extension and also the 62 percent retracement from the $1307.41 swing high.

On the downside, the chances of testing $1000 are highly dependent on whether support at $1045, $100 below resistance, is broken. If so, $1000 will have 2:1 odds.

$1045 is Kase DevStop4.5 on the daily chart, and $1000 on the weekly. $1045 is the lowest extension for the most recent wave down from Monday’s reaction high of $1119.10. Below $1045, targets from larger waves extending to $1000 are engaged. $1000 is the Phi2 corrective projection for the swing 1072.45 – 1119.1, and again for the swing 1142.7-1232.3.

Most importantly, the wave down from $1307.41 that has met its 1.0 projection at the current low, targets $1000 as its next, 1.38, extension.

For the optimists who went long on Monday or Tuesday, we’d suggest extreme caution until there’s a solid close over $1145. I’d use tight stops at previous swings around $1085 and $1075, but if you want to take more risk, $1065 is the critical target above $1045, and the key DevStop1 on the weekly.

If I were short, I’d stay short with stops at $1145 for now. This is about $70 up from the low. Should prices decline cleanly lower, I’d narrow my stop, first to $57, and then to $45, or use all three values for a scale-out exit.

Meantime, I’m expecting that if you keep your eye on the technicals, and are disciplined about exits, you’ll surely be golden.

Send questions for next week to askkase@kaseco.com, and for energy hedging visit www.kaseco.com.