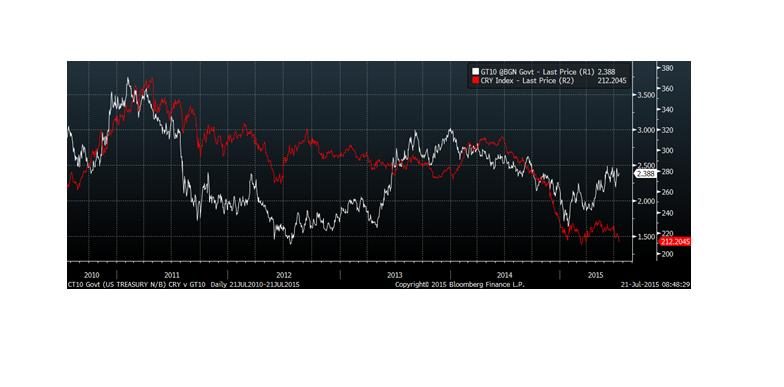

See below— a chart of the CRB index (red line) versus the ten year treasury yield, white line. As you can see, the relationship between the two is sometimes tight and sometimes a bit on the loose side. From the second half of 2014 to the beginning of this year the relationship was pretty tight. However, as 2015 has progressed, there has been more and more of a divergence. The CRB is close to making multi year lows, while the ten year yield has firmed up on the expectations of a rate hike. In fact, in the past decade the CRB only traded lower than its low of 2015 (which is now being encroached upon) at the height of the financial crisis in early 2009, when the price of crude had spiked down to $32.40 bbl.

In some ways the weakness in CRB reflects the strengthening dollar. CRB is also heavily weighted toward crude oil (petroleum products make up 33% of the index), so the deal with Iran might also be a factor with the idea of additional supply washing over the market. However, even products which aren’t denominated in dollars, for example Dec 2015 Milling Wheat, have turned lower. Dec Milling Wheat reached a recent high of over 206 €/Metric Ton but pulled back to 192 by Monday, a new low for July. (Milling Wheat symbol is CAZ5, and trades on Euronext at €50 point). Whether priced in dollars or not, the global grain rally in June sputtered in July.

Over the taper tantrum in the summer of 2013, the ten year yield ultimately went a bit over 3% from a low of 1.63%, from May until the end of the year. At the time the CRB was edging sideways to slightly lower. In January of this year the ten year note again touched 1.64%, and has been generally zig zagging higher since then, but now seems to have stalled below 2.50%. However, the CRB is probing lower which probably tells us something (negative) about the state of the global economy. Of course, with lower oil prices, the middle east exporters no longer need to recycle dollar receipts into treasuries, and some emerging markets have likely been paring dollar reserves (in the form of selling treasuries) as they have run into economic problems. However, barring some spectacular news from the Employment Report to be released August 7, yields will likely edge lower.