This is what buying the dips looks like. The S&P500 mini futures (ES) gapped down sharply overnight. But as soon as the day session opened, new buyers started entering the market on volume just above the 2100 support level. The low for the day 2102.25, was made in the early session, and the price recovered from that point on.

The futures stayed red all day, but closed well off the lows at 2108.00, 6.50 points below the previous close, but above the 10-day moving average. The price continued to climb overnight in the early after-hours trading.

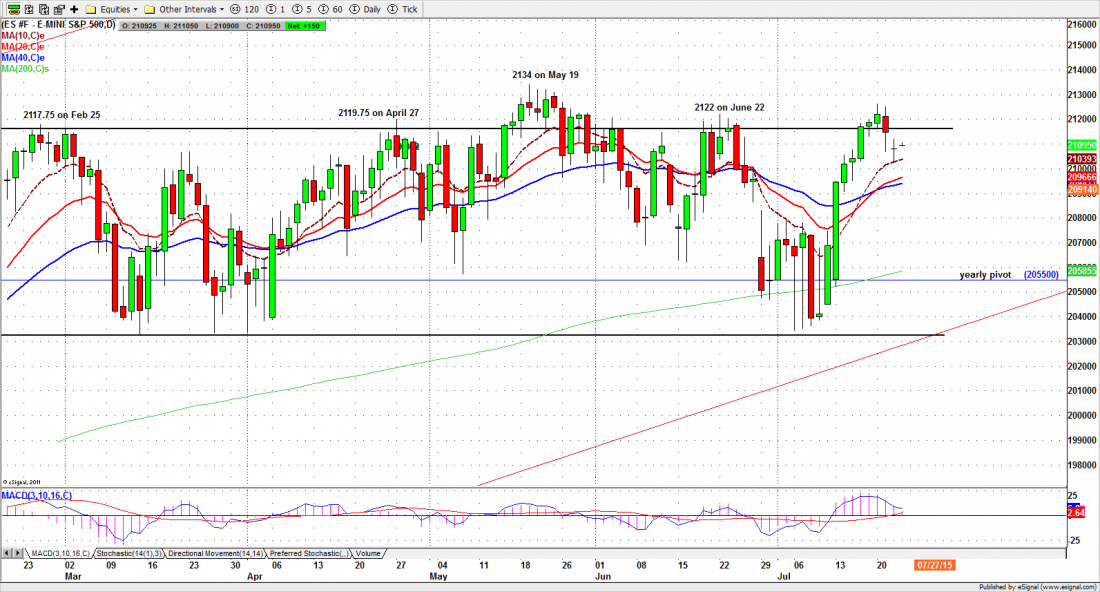

A glance at the chart shows what is happening. The ES dropped to the bottom of the sideways range that has been containing the price since March and bounced very quickly to the top of the range. It has now started to retrace.

So far we consider the current decline as just an ultra-short-term correction, intended to solve the short-term overbought problem. As long as the price stays above the 10-day moving average line, the short-term uptrend is intact.

Today

Today 2100-2095 remains a key zone. The ES needs to hold this support in order to have a shot at the resistance overhead at 2125-35. In the early morning sessions today (Thursday) we may see a testing of yesterday’s low or a move a little lower near 2092.50-94.50 zone (doubtful!) if the 2114.50 level holds the ES down during overnight trading.

However a break above 2114.50 could lead the ES back up to 2121.75-23.50 or higher . We will continue to see “buying on the dip” moves, and we will be focused on the buying side today.

Major support levels for Thursday: 2100.50-01.25, 2095-92.50, 2085-88.75, 2062-64;

major resistance levels: 2128.50-29.50, 2134.50-36.50 and none

For more detailed market analysis from Naturus.com, free of charge, follow this link