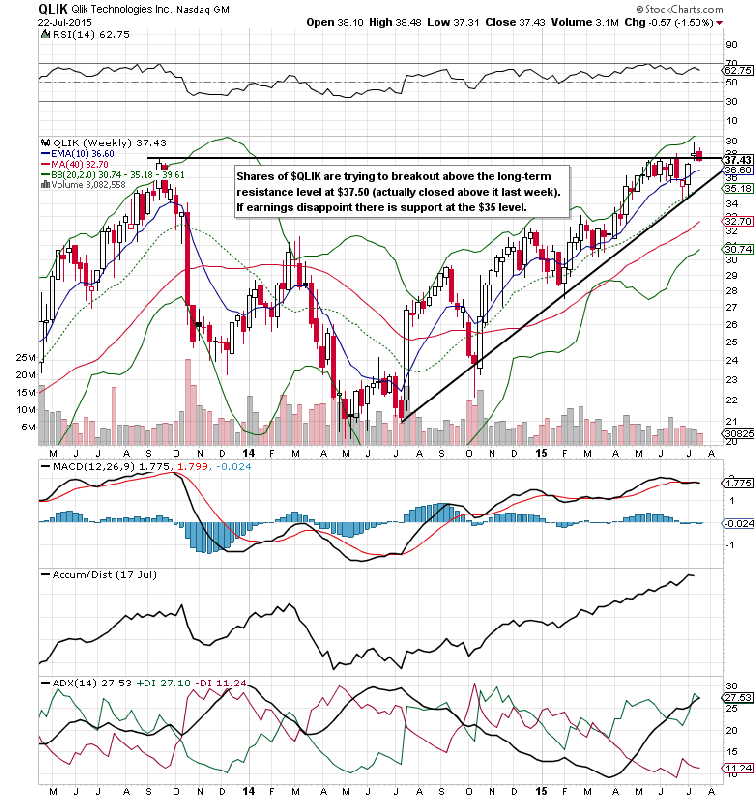

Qlik Technologies is the $3.4B data visualization software company that offers products such as QlikView and Qlik Sense. On April 23rd, they reported Q1 EPS of -$0.09 vs the Wall Street consensus estimate of -$0.14 on revenue of $120.3M vs the $113.9M estimate (+23% ex currency on a year over year basis). Given the projected acceleration in earnings (42% this year to 53% in 2016) and sales (9% to 18% in 2016 to $715M), Qlik could be a potential takeover target to the likes of Tableau Software or some other big competitors.

Shares trade at a price to sales ratio of 5.67x and a price to book ratio of 10.73x. On June 22nd, Cowen kept their buy rating and raised their price target to $43 from $41. More recently on July 20th, Bank of America upped their price target to $45 from $40. Q2 earnings are due out on July 23rd (shares have moved higher after earnings on 4 out of the last 5 reports).

Unusual Options Activity

There was a rollout from 2,362 QLIK July 17 $35 calls ($3.45 credit) into 5,000 July 24 weekly $39 calls ($1.55 debit) on July 16th. The July 17 $35 calls were bought for $1.20-$1.30 on July 2nd. He/she then likely adjusted the trade on July 22nd as there was a rollout from 3,530 July 24 weekly $39 calls ($1.00 credit) into 2,056 July 24 weekly $36 calls ($2.50 debit).

It is also important to make note that a rollout from 3,000 May 15 $28 calls ($6.20 credit) into 6,000 Nov $36 calls ($3.30 debit) occurred on May 6th. All in all, options traders are bullish on the outlook of the company in the short-term and longer-term.

Qlik Technologies Options Trade Idea

Buy the July 24 weekly $37.50/$40.50 bull call spread for a $1.20 debit or better

(Buy the July 24 weekly $37.50 call and sell the July 24 weekly $40.50 call, all in one trade)

Stop loss- None

1st upside target- $2.00

2nd upside target- $2.95