The SPDR Gold Trust (GLD) was originally created in November of 2004, when the fund was listed under the name StreetTRACKS Gold Shares on the New York Stock Exchange. It was sponsored by State Street Global Advisors and the World Gold Council. Shares have traded under the SPDR name since May of 2008. Unlike most other commodity ETFs, which use futures contracts, the fund is a trust and holds physical gold.

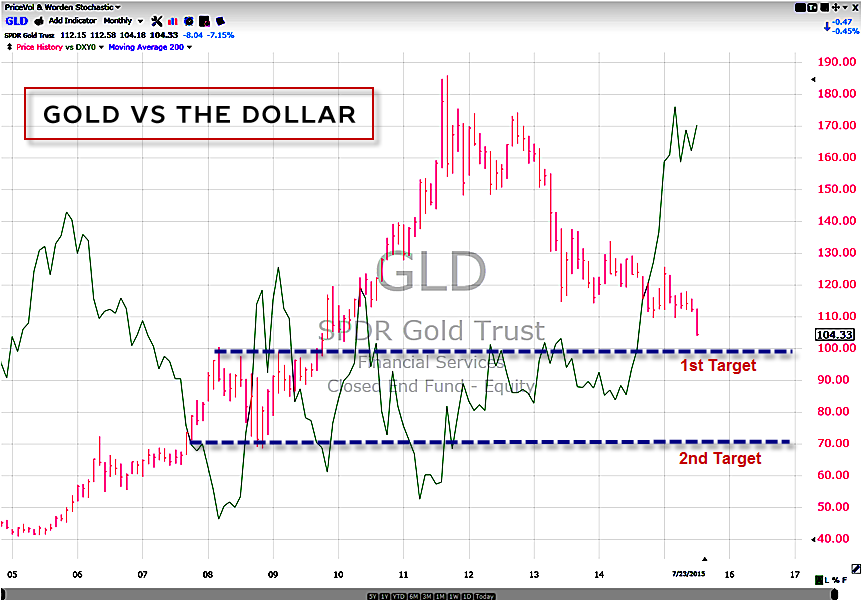

The chart on the left shows the start of the bull market in gold in 2005, but it really began to pick up steam in early 2008 as the financial crisis shook confidence in the banking system. The putative role of gold as a psychological safe haven was enhanced by media images of stacks of gold bullion in London vaults.

During the “Great Recession” of 2008-2009 many lost confidence in the equity markets and in the U.S. financial system in general. They believed that the Fed was wrong to print money and they bought gold, thinking the dollar would weaken and eventually be devalued.

They were half right.

The dollar remained stable but gold was able to double from its January 2009 level over the course of the next 2 ½ years. Since then, however, faith has gradually been restored in the equity markets and in the greenback. And since mid-2014 the greenback has been particularly strong in relation to the troubled euro. These dual factors are like a vise, squeezing yellow juice out of the gold bugs.

If the psychological dynamics typical of bear markets play out, gold lovers will need to fully capitulate (liquidate) to complete the bear market. Gold needs to become a hated commodity. That capitulatory level is around $70 in GLD, which corresponds to a price of $700/oz.

The paired trade, long equities/short gold, which has been working for several years, should continue to produce gains until gold reaches its final resting place. RIP. And logically, tracking the death of gold is one way to time the top in equities.

So relax, we are not there yet.