If you’ve been reading my commentary over the past five weeks on TraderPlanet you’ve probably noticed a couple that were focused on the Nasdaq ETF (QQQ). To me this has been a great way to filter out single stock earnings risk from the likes of Apple, Microsoft, Amazon, Facebook, and Google (3 went up, 2 moved lower) in the more volatile tech/social media area of the market.

Moving forward to the present day, I’ve changed my tune from bearish to bullish (as of July 16th). On July 29th, this was reaffirmed by stocks tacking on gains after the 2:00 P.M. EST FOMC statement for July that to no one’s surprise didn’t end with an interest rate hike (still at 0.00-0.25%). Fed Funds Futures for September are now essentially pricing a 0% chance at that meeting. While quantitative easing is gone in the U.S., we still have historically low borrowing rates helping corporations (not great for the banks and insurance companies). With issues in Greece and China dominating the headlines lately, it is probably fair to say there won’t be a long awaited hike until sometime in 2016.

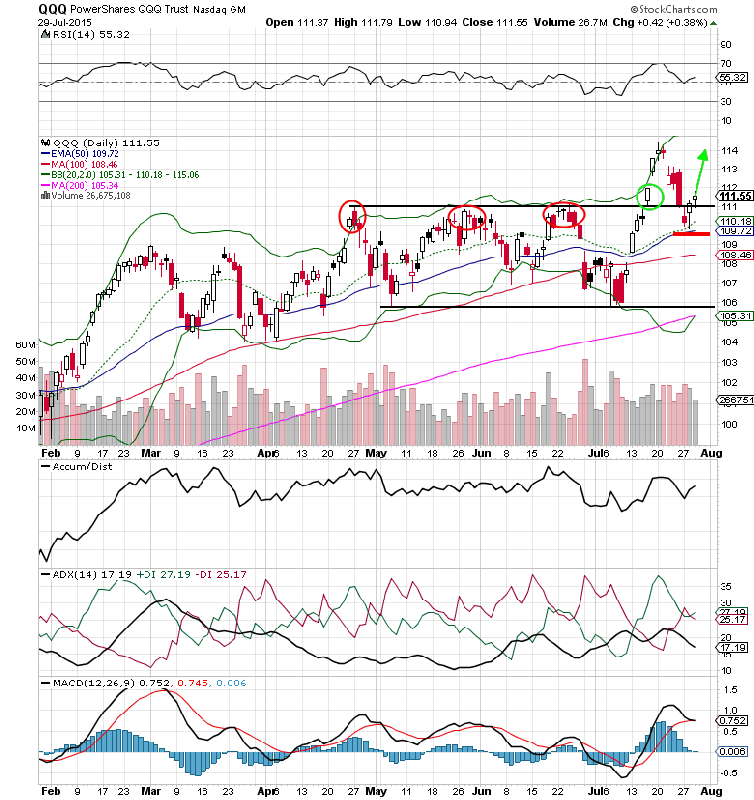

The breakout above the $111 resistance level in the QQQ on July 16th sparked a $3+ rally in the following days, but in the same amount of time it retested the new current support level near $110-$111. Now the Nasdaq ETF is starting to attract buyers, which sets up for a low risk trade with a stop loss under $109.70 (50-day EMA). Look for a move to $114 at a minimum, possibly to the measured move target of $116 in the next two months ($111-$106=$5+$111=$116).

PowerShares QQQ Trust Options Trade Idea

Buy the Oct $112/$116/$120 call butterfly for a $1.05 debit or better

(Buy 1 Oct $112 call, sell 2 Oct $116 calls, and buy 1 Oct $120 call, all in one trade)

Stop loss- None

1st upside target- $2.00 or a move to $116 in the ETF

2nd upside target- $3.50