The Street assumed that the Fed’s silence on raising interest rates in 2015 means no rate hike this year. That may not be true, but it put the S&P500 mini-futures (ES) back into a bullish cycle and helped it hold the price above the key 2100 psychology line.

The futures pretty much duplicated Wednesday’s action: dropped sharply from the overnight high and made a low one point above Wednesday’s low, then climbed back up to make a high half a point below Wednesday’s high, and closed one point above Wednesday’s close. Lots of action, no progress.

Today

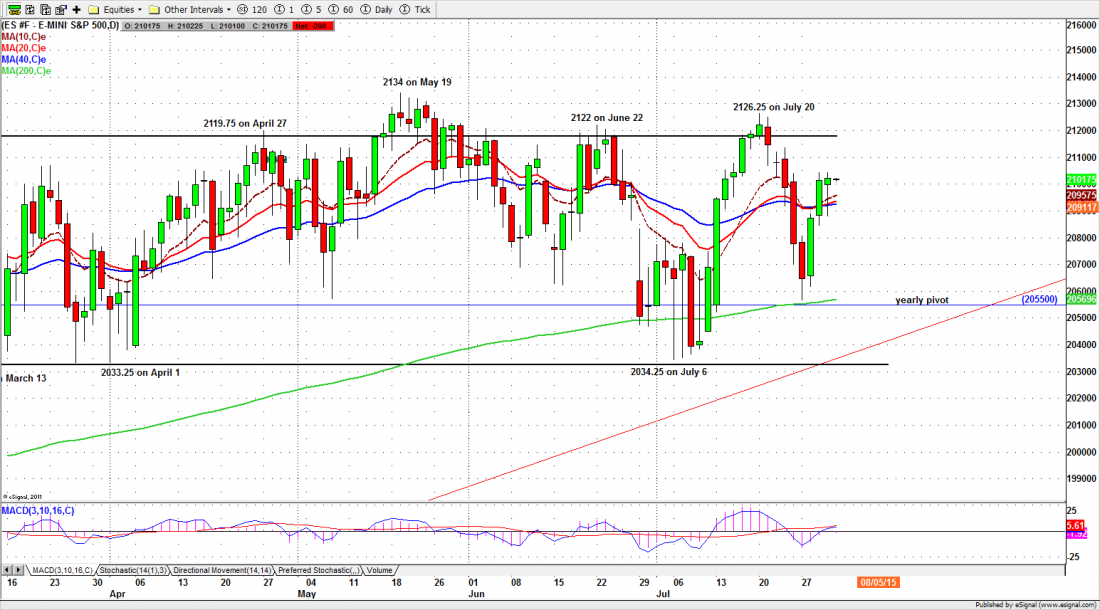

Today is the last day of July, and the closing price will give the outlook for next week and next month. If the ES closes above 2106 today, we expect next week will have the Bulls running; if it closes below 2090 the Bears will dominate. You can bet that both sides will be doing everything they can to win the battle for today’s closing price.

There are buy stops resting above the 2104.50 line, and if they are hit the shorts will be squeezed and the price could be pushed up to the 2113-16 zone. However the price needs to stay above 2093.50 to give a realistic shot at breaking above 2104.50. Failure to hold above 2093.50 could drop the ES back to the 2082-2078.50 zone to search for the next support area.

Major support levels for Friday: 2054-55, 2035-32, 2025-23.50, 2018.50-16.50;

major resistance levels: 2128.50-29.50, 2134.50-36.50 and none

For more detailed market analysis from Naturus.com, free of charge, follow this link