It was the age of wisdom, it was the age of foolishness; an epoch of belief, an epoch of incredulity. In this Dickensian market, investor sentiment, according the America Association of Individual Investors, is equally split between believers and the incredulous, although a hefty 44% are admittedly clueless. And this week’s Commitment of Traders report indicates that even the largest traders have a perfectly neutral stance. The market engine is idling.

Nevertheless, the major indices, which have been moving in a synchronized manner for years are only now starting to diverge. The Dow is weakening while the Nasdaq 100 is hanging tough.

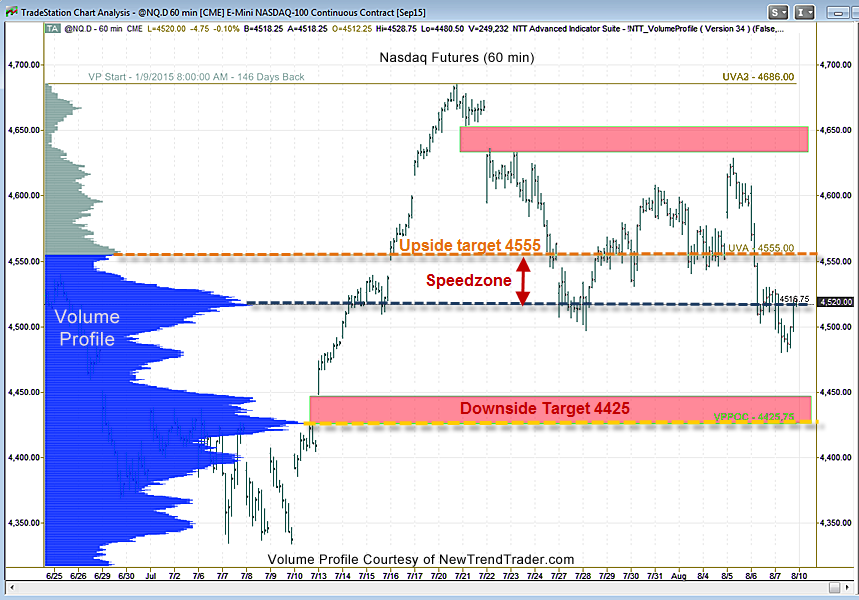

Indeed, the Nasdaq 100 is not a market particularly concerned about the downside. Yet, the Volume Profile chart of the NQ futures indicates that the NQ is testing a key resistance level (the High Volume Node at 4520) from below and the large gap at 4425 begs to be filled.

That said, on Monday the bulls could easily push the NQ up through a speedzone and land at 4555 in just a couple of hectic hours. Whichever way the market heads first, I would keep an eye on 4425 this week, which is also the Volume Profile Point of Control.

If you would like to receive a primer on using Volume Profile, please click here: www.daytradingpsychology.com/contact