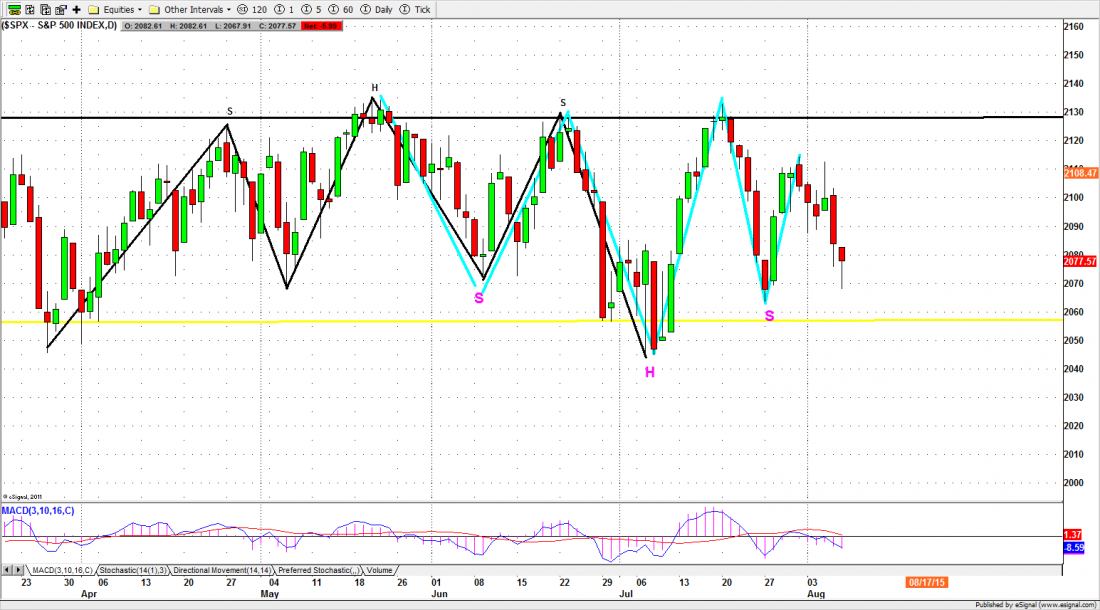

The S&P500 large-cap index (SPX) closed at 2077.57 on Friday, down 26.27 points for 1.25% net weekly loss. It was a week when “we shoulda stayed in bed”. The range for the entire week was a very modest 45 points, and there was very little that was tradeable about the price movement.

Most of the week was spent between 2100 and 2080, with a dive on Friday afternoon to scare the Put sellers and encourage the Bears. The drop into the close suggests there is more to come on the downside.

This market is looking very toppy. The SPX has been trading within a fairly narrow range (2135 to 2040) for six months, it has now made five attempts to break the top of that trading range and dropped back each time, and it has not made a 10% correction since October of 2011.

We are entering a seasonal period that is bad for equities, and the consolidation range feels like it is getting smaller and smaller. Sooner or later, something is going to pop.

This week

The 2050-55 area has been an important support level for the SPX and it will be critical for the next few weeks. For five months the index has been unable to close below that level on a weekly basis; a close below that support will set the index up to start thinking about lower low.

Maybe much lower: We have been expecting (and saying publicly) that 2015 would be a year of consolidation, and we tentatively identified a range from 2136 to 1970. While we have hit the top repeatedly, we haven’t come close to challenging the bottom of the range. The next couple of weeks may give us a start toward that direction.

ESU5

The S&P500 mini-futures (ES) closed at 2073.50 on Friday, 11 points off the low of the day, thanks to a late-day surge that rescued some of the Put sellers. But the close was still below the day’s key line, and it hints at more declines to come.

The level to watch today is 2078.50. A break below it will encourage the Bears to take a run at 2059. If that level breaks we may run some stops that could take it down to 2055-50, or lower.

If we can move above 2078.50 there may be a little higher bounce first, to allow some of the early Friday buyers to get out of their positions, but it shouldn’t move much past 2083 — if it gets that far.

Major support levels for Monday: 2054-55, 2043.50-45.50, 2038-35;

major resistance levels: 2126.75-28.50, 2134-36.50 and none

For more detailed market analysis from Naturus.com, free of charge, follow this link