Tesla (TSLA) is a company and a stock investors either love or hate. I happen to love the company and the car, but I try to be objective about the stock. Unfortunately for the bulls, it appears that the Tesla bears may soon have something to celebrate.

Shares opened the year around $222 and a relentless short-squeeze pushed prices to $286 last month, within $5 of an all-time high. After climbing rather briskly since early April, shares of the revolutionary EV manufacturer have been under pressure since its quarterly report on August 5, when management reduced vehicle production targets for 2015 by about 10%.

One analyst downgraded the stock to a “sell” and several more have trimmed estimates. Nevertheless, of the 19 analysts who cover Tesla Motors, ten still have ‘buy’ or ‘strong buy’ ratings and 4 rate the stock a ‘hold.’ During the conference call, CEO Musk reaffirmed his 2020 production target of 500,000 cars/year and analysts still give credence to Musk’s long-term views.

Interestingly, this heady ramp up has an historical precedent. Henry Ford drove Model T production from 10,000 cars per year in 2009 to 500,000 in 2016. With a factory full of smart robots, Musk should be able to meet or exceed Ford’s manufacturing trajectory.

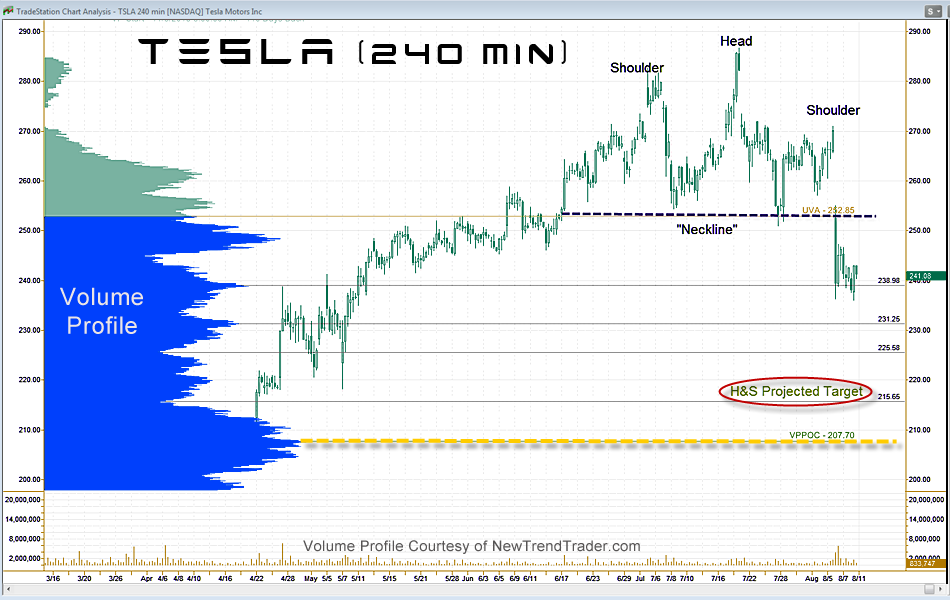

From a technical perspective, however, shares of TSLA may have printed a classic “head and shoulders” top on the weekly chart (not shown). On the 240 min chart that accompanies this article one finds a similar H&S pattern over the last two months. The neckline broke after the earnings call and the pattern projects to ~$218 (the distance from head to neckline is subtracted from the neckline level to generate an approximate target.)

Markets are fractal (similar across various timeframes), so Tesla lovers should be prepared for a deeper correction. Currently, shares are bouncing off a high volume node at $238. If that level fails, however, the stock is likely to stair-step down to $225, $215 and then as low as $207, the Volume Profile Point of Control.

If you would like to receive a free primer on using Volume Profile, please click here.