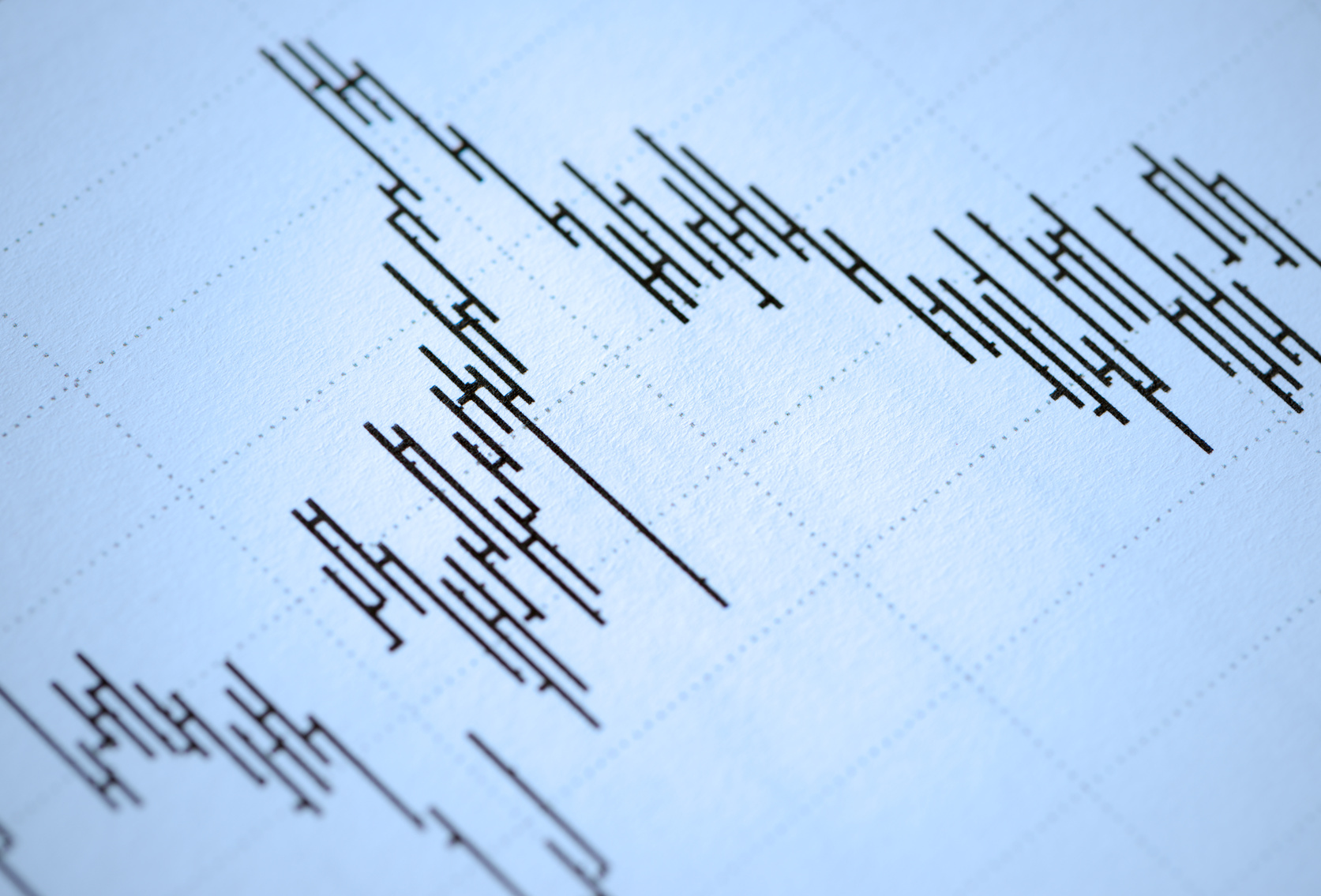

Moving averages act like a magnet to price, and when it gets too far stretched away from the basic moving averages (up or down) we tend to see mean reversion. If a trend is in place the moving averages will follow price lower or higher, but that tends to happen when markets are also trending.

A reversion to the mean is simply a stock returning to the moving averages, a measure of central tendency. Some traders love to play these moves as the probabilities tend to favor a reversal of the trend – at least temporarily.

Unless a stock is heading to the trash pile there are always opportunities to trade contrarian to the trend, but just be mindful these often stop when the moving averages are tagged. More often than not the prior trend is continued, so if you are playing mean reversion you want to use trailing stops.

For option players, know that implied volatility is low in a trending stock without any ‘news’ or event on the horizon. Hence, to buy calls for a mean reversion trade you would be purchasing cheaper than normal options UNLESS they were at the money. Why so expensive here? Because the market is expected some sort of ‘relief rally’ and will make the buyer pay up for it. Hence, that move back to a moving average may not press that already juiced up option.

Moving average analysis with different tools such as MACD, envelopes, Bollinger Bands® and a series of MA’s can produce some very very good results, just be cautious with trending names, they will turn and bite quickly.