Despite the global economic recovery since the 2008-09 global financial crisis, global bank stocks have generally underperformed the broad markets. Over the last five years, Morningstar’s index of global banks has only retuned 5% annually, while the MSCI All-Country World Index returned more than 10% on an annual basis. According to McKinsey’s 2014 Global Banking Annual Review, the underperformance in global bank stocks over the last five years is due to: 1) ongoing regulatory pressures, especially on banks with a global reach. From 2010 to June 2014, banks paid $165 billion in fines and settlements, 2) weakness in Western European bank lending; as such, the average return on equity (ROE) was only 2% for Western European banks, and 3) new regulations are challenging the global bank model, with additional capital requirements for larger banks that are offsetting the benefits of geographical diversification and economies of scale.

HSBC is one such example that has suffered from the additional regulatory burdens (despite being the only global bank that did not report a loss during the 2008-09 global financial crisis). Over the last 12 months, HSBC is down by 14% (in line with Morningstar’s global bank index). Despite this underperformance, my long-term outlook for HSBC remains bright. I believe HSBC will outperform both global banks and the market as the firm: 1) focuses building its highly profitable Asian operations, 2) benefits from the ongoing recovery in Western European bank lending, and 3) exits or cut costs to improve the profitability of its Latin American businesses.

HSBC has a market value of $155 billion, and an annual dividend yield of 4.6%. I find HSBC to be a compelling growth & income play for three reasons.

- 1. HSBC to focus on its highly-profitable Asian business with a 20% ROE

Over the last 12 months, HSBC’s ROE was 7%, vs. its long-term target of 10%. This was due to the “risk off” lending environment in Western Europe (HSBC’s European business contributed about one-third of the firm’s revenues), as well as HSBC’s underperforming North American and Latin American businesses. Meanwhile, HSBC’s Asian business’ ROE has consistently hit 20%, due to the region’s higher-than-average growth in bank lending and wealth management services. According to Capgemini’s 2015 World Wealth Report, Asia (ex. Japan) continues to experience the greatest growth in the number of millionaire households. Despite the recent volatility in the Asian equity markets, I expect this trend to continue for the foreseeable future.

HSBC’s Asian business is by far the most profitable; yet, it contributes less than 40% of the firm’s revenues. Over the last two months, HSBC’s CEO, Stuart Gulliver, has reiterated the firm’s focus on China’s Pearl River Delta area, with at least half of the firm’s recently-freed capital to be deployed into this fast-growing region. With this renewed focus, I expect HSBC’s firm-wide 10% ROE target to be met in the next two years.

- 2. Lending activity continuing to pick up in the Euro area

According to the recently-released 2Q 2015 Euro area bank lending survey, bank credit standards for all loan categories in the euro area continued to ease in 2Q 2015. Credit standards on loans to enterprises continued to ease, while credit standards on loans to households for home purchases eased considerably. Moreover, the survey reported a continuing rise in net loan demand to enterprises, with net demand for housing loans increasing considerably. With respect to the latter the two factors cited as drivers of strong housing loan demand were low levels of interest rates as well as prospects of a stronger European housing market.

I expect European bank lending to continue its recovery. The recent resolution of the Greek fiscal crisis (which detracted from European bank lending even though no non-Greek banks had significant exposure to the country), as well as the implementation of the European Banking Union early next year, will improve the prospects for European bank lending, creating more business opportunities for HSBC and other banks with a large presence in Western Europe.

- 3. A better-than-expected exit from its Brazilian business

Last year, HSBC’s Latin American business (which makes up 10% of the firm’s revenues) underperformed, hitting a ROE of less than 2%. For the first half of this year, the firm’s Latin American business grew its profits before taxes by 26%; however, it is clear that HSBC does not possess economies of scale, nor an established foothold in Latin America. Two weeks ago, HSBC announced an all-cash sale of its Brazilian business for $5.2 billion. At 1.8 times tangible book, this was substantially higher than I expected; it is also higher than what Reuters was reporting prior to the sale ($3.75 billion). This sale will be accretive to HSBC’s value going forward.

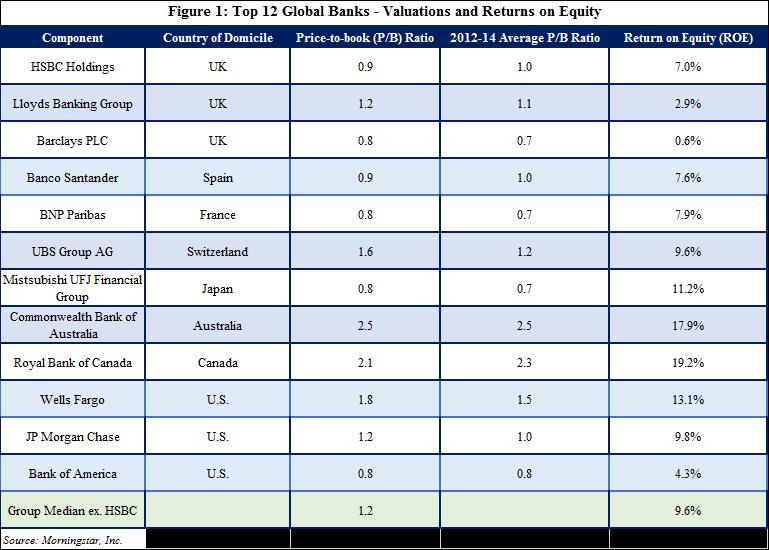

As such, I believe HSBC’s stock deserves a re-rating. As seen in Figure 1 below, HSBC’s price-to-book (P/B) ratio is 0.9, which is below its three-year average of 1.0, and the global bank median of 1.2. As HSBC re-rates, I expect HSBC’s P/B ratio to hit 1.1 (i.e. the mid-point of its three-year average and the global bank media). I also expect HSBC’s earnings to grow by 7.5% annually over the next two years. The combination of this re-rating, along with earnings growth, should propel the stock higher by over 35%. Taken together, my target price for the HSBC ADR is $57 in two years.

Disclosure: My firm, CB Capital Partners and I hold shares in HSBC.

Bio:

Henry To, CFA, CAIA, FRM is Partner & Chief Investment Officer at CB Capital Partners. Established in 2001, CB Capital Partners is a global financial advisory and investment firm headquartered in Newport Beach, California, with an office in Shanghai, China and an affiliate office in Mumbai, India. Visit http://www.cbcapital.com and http://www.cbcapitalresearch.com for more information.