The decline in crude oil prices has become dramatic.

Crude oil has fallen by more than one percent every day for each of the last thirty days; now down more than 32% since June 25th. While there is little doubt that this sell off reflects a slowing global economy combined with the largest production glut of all time, even an outlook this negative can get ahead of itself. Throw in Friday’s equity market sell off and what could be sold, was sold. That being said, it’s time to see who’s buying and commercial traders (refiners) in the crude oil market have been net buyers for eight straight weeks. We’ll also look at spread and technical analysis to make the case for a downward trend that’s gotten ahead of itself.

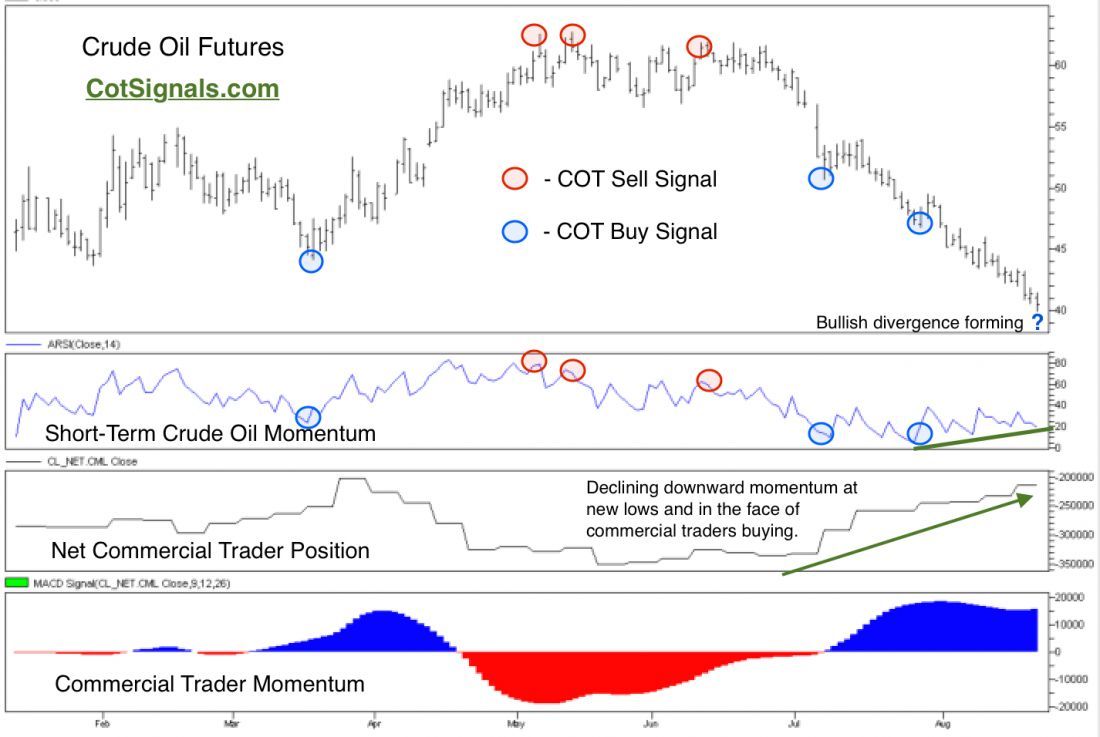

We can combine the action in the commercial trader position with the action of our short-term crude oil momentum indicator in the second pane of the chart below. The floodgates opened as crude oil fell below $50 per barrel and made new lows in 16 out of the last 22 trading sessions. However, the low reading on our momentum indicator was made on July 27th. Each subsequent low has been made on slightly higher momentum readings. Higher momentum readings in the face of new lows in the underlying crude oil contract creates a bullish divergence technical pattern that can be indicative of an imminent reversal of direction.

Our last piece of evidence for the declining pace of crude oil’s decline and reversal trading opportunity comes from the calendar spread market. Crude oil is delivered in all 12 calendar months and is priced higher the farther out the delivery date due to storage insurance and interest expenses. Analyzing the spread differences can provide key insight into the expectations of the crude oil future prices. The collapse of the December 2015 minus October 2015 from nearly $2.18 on August 13th all the way down to $1.46 by Friday’s close indicates a genuine washout in the front month, October. For comparison’s sake, the March 16 minus December 15 spread fell from $2.56 down to $1.97. Deferred contracts are beginning to strengthen on a relative basis.

Crude oil has sucked an incredible amount of speculative money into the short side of the market. More importantly, each of these players has been rewarded as the market has continued to decline, thus fueling their fire. The combination of refiner purchases showing up in both the net commercial trader position and the strengthening back end of the spread market suggest the decline may be nearing a pause. Given the pace of this market’s decline, it’s not unreasonable to believe that a rapid unwinding of recently added speculative short positions could fuel a reversal higher just as rapidly.