Conventional wisdom tells us to avoid trading in the first few minutes that a market opens. The action is often volatile and seemingly unpredictable. May people wait for the first 15 minutes to pass to let the market “show its hand”.

In this article, we are going to discuss an opportunity that occurs very close to the open; in some cases, giving a trade entry in the first minute. This opportunity is one that you will be able to see quite clearly for yourself, if you take time over the coming weeks to watch for the things we will discuss.

Before we consider the trade opportunity itself, we have to consider what an “open” is.

Many markets are open 24 hours a day. If we look at the CME Futures, their index futures products open at 5pm Central time. Anyone that’s looked at the index futures at 5pm Central time will know the markets are very quiet at that time. It’s the lull between the close of US banks to the open of the Asian banks. Even though that markets open at 5pm, that’s not what people generally refer to as the open.

The US Futures markets remain quiet until the Asian banks and prop shops open. So we have an “Asian open”. Most US markets remain fairly quiet at those times. The US indices remain fairly quiet but some markets have decent range and volume at those times. Crude oil and the Japanese Yen Futures are examples of markets that are actively traded in the Asian session for obvious reasons.

Later in the day, Europe joins the fray. The Eurex exchange in Frankfurt opens and that’s when the Eurostoxx 50 and Bund Futures start trading but most of the time that first hour is pretty quiet. Then the London markets open and that’s when we see volume pick up. The volume from London is huge, Crude Oil, Euro Futures, Interest Rate Futures all see good volume and healthy ranges. The stock index futures in Europe aren’t as volatile as the ones in the US but arbitrage does keep them in line most of the time. We higher better volumes and range once London opens in comparison to the Asian session.

And then to the US open. What is that exactly? Well, for those of us trading index futures, some of us used to call the day session the “pit session” in reference to the times the CME trading floor opened. Now that most of the trading floors are closed, that doesn’t make much sense any more. For index futures traders, the key opening time is the time the US stock exchanges open which is 9:30 am Eastern Time. Of course there is “pre market” stock trading which is generally light but at 9:30am the stock market opens to all and the volume in the corresponding futures markets increases. More people (and computers) come in to play those markets.

Trading floors haven’t disappeared for all markets yet but for a long time their volume has been overshadowed by electronic trading and in some markets it’s more tradition than any underlying market that causes the volume to increase at the “open time”. This could change over time and opening times could eventually become irrelevant for certain markets. But for now, that hasn’t happened and most markets have an open time where trading activity increases because a lot of traders in the US start for the day. People have positions to put on at that time of day and that’s why we see a rush of orders.

Volume increases, in most Futures markets the US leads in volume but a lot of the time there is significant volume traded up to the US open, mostly from Europe. It is this volume of trading or rather, the positions and liquidity of these traders into the US open that provide us with opportunity.

This opportunity isn’t one that you can just jump on once you know what to look for. It requires practice and understanding of specific market nuance. So if you read this article today and attempt to take the trade tomorrow, you may get lucky or you may not. What you will not be doing is actually taking the trade based on all the factors involved, one of them being experience in this type of action. I would advise watching the open for a month or two and get to understand how it moves before even considering a trade in that area. If you jump in and start trying to trade it for the next few days and it doesn’t work out – then you will say “that’s nonsense” and move onto the next thing you’ll give a 2 day shot. This of course, puts you in the majority of “wannabe traders”. So take your time.

The first thing you are looking for into the open, are areas where a lot of traders are positioned as you get close to the open.

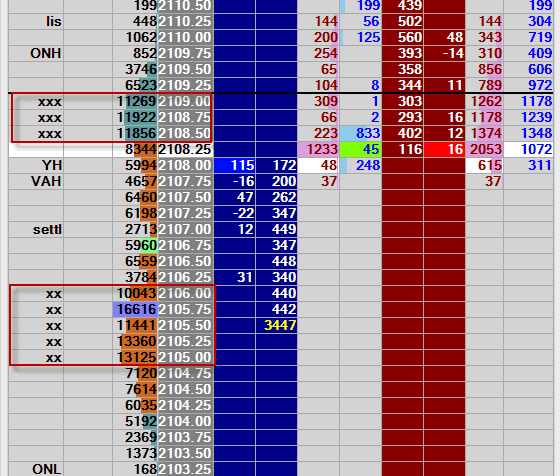

Figure 1 – Overnight Volume Profile eMini S&P500 (Jigsaw Trading DOM)

The third column from the left shows the volume profile, the number of contracts traded at each price.

In this case, we can see 2 areas with significant volume. The first at 2105.00-2106 and the second at 2108.50-2109. Significant volume varies by market. If the prices with the most volume here was just 4-5,000 it wouldn’t be significant for this market. So one of the things you need to do is to get observe what levels of volume are significant into the open in your specific market.

As we move into the open we want to see price either within one of these high volume areas or fairly close to it.

Figure 2 – The open action (MultiCharts Chart)

As you can see we were moving sideways into the open – in the 30 minutes prior to the open we were trading around 2104-2106 with one move as high as 2106.75, building more volume around that high volume area from Figure 1. We opened just below that area, moved a few ticks up and the market then reversed.

This happened all within the first minute. Quite often you will see it move up and tag the high volume area and then move swiftly away from it. There is no magic here; you have a lot of positions in that area. Some short and some long. We are already below that area, so longs are nervous. Shorts are feeling good and just need to push the market a little to force longs out of position. These areas also represent places where a lot of liquidity potentially resides which acts as a sponge for trades against you.

These high volume areas are good for a bounce. Sometimes that bounce is significant, sometimes it’s just 3-4 ticks and then it comes back at you, in which case, the premise for the trade is gone and staying in ‘hoping’ that it’ll carry on your way is not a great idea.

Here’s another example

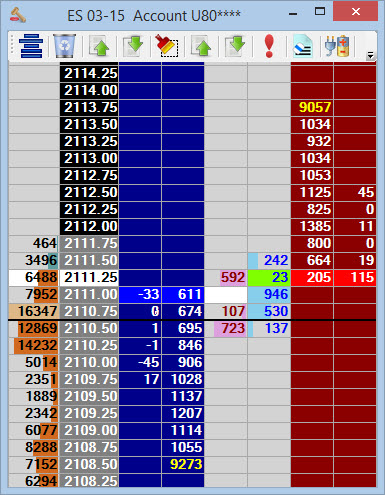

Figure 3 – Overnight Volume Profile eMini S&P500 (Jigsaw Trading DOM)

Once again, we see an area of high volume, this time 2110.25-2110.75. Let’s see how the market opened:

Fig 4 – The open action (MultiCharts Chart)

In this case, we opened and moved up way above our area of high volume. In the 3rd minute we came down to test it. We went to the bottom of that high volume area (2110.25) – briefly traded 1 tick below it and then moved up to 2111.75. In this case, the area held but there was no real follow through, so this is a case where we’d have either had to take small profits or cut the trade when it came back to the bottom of our volume zone.

Now, of course, you could observe that if we’d put in a stop of a few points below the high volume area we could have held this trade till the high of the day. That’s true in this case but if you observe this behavior over the next month or two, I believe you will come to the same conclusion as me – that you need to be brutal in cutting these trades if they come back at you. If the high volume area fails to hold price – your premise is no longer valid and you are in ‘coin toss’ territory.

My preferred method of managing trades is to scale out and on the eMini S&P500 my first scale out is usually 4 ticks. You could actually exit your entire position at 4-5 ticks on these trades as they do often just create an initial bounce you can capitalize on.

As with any trading opportunity, you need to make this one ‘yours’. The key elements in benefitting from this opportunity are:

- Knowing what times your market “opens” and why.

- Knowing what level of volume/liquidity is significant and insignificant in your market.

- Knowing when a high volume area is to wide to trade. You really want a small, focused area of volume.

- Being able to cut a trade quickly when it’s not working out. Those that stop like a deer caught in the headlights will not fare well here, You have to be brutal in accepting a trade that is coming back and just get out.

- Watching the volume profile into the open and observing the action 30 or 40 times and making notes. So about 2 months of opens should give you a good idea of what to expect.

As mentioned at the start, conventional wisdom tells us that you should not trade in the first few minutes but it really ISN’T the first few minutes of trading. It’s just the first few minutes that a lot of new participants come into the market. As long as you see signs that there is significant liquidity and positions close to the open price, there is a good argument for that liquidity holding the market as well as one side bailing out when it is clear it’s moving one way away from the zone.

Sometimes we just get a small bounce and sometimes we get an extended move. It’s a bounce – sometimes it follows through, sometimes it doesn’t. As such your trade management should reflect that fact.

Peter Davies

Jigsaw Trading

www.jigsawtrading.com