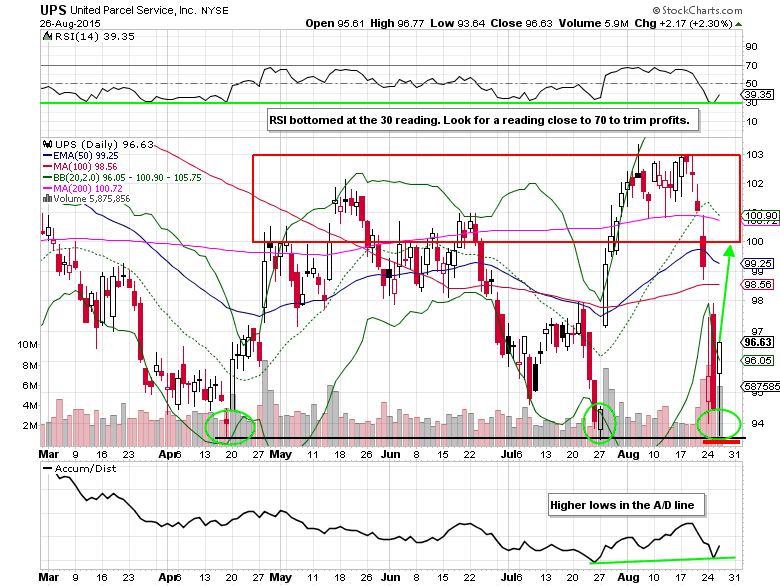

Shares of United Parcel Service shook off a downgrade from Zacks and mid-day market sell off to finish higher by more than 2%, printing a bullish hammer candlestick after nearly hitting lows not seen since last October. This would mark the third major support around the $94 support level since mid-April. Now is the time to consider taking a long position, using a stop loss under the August 26th low of $93.64. Major resistance remains in the $100-$103 area (reward/risk ratio of better than 2:1).

The $86B package delivery company trades at a P/E ratio of 16.60x (2016 estimates), price to sales ratio of 1.45x, and an enterprise value to revenue ratio of 1.57x. Earnings estimates for 2015 and 2016 have actually been on the upswing ($5.19 to $5.28 per share for 2015 in the last three months) during the last seven months of sideways price action. Sales growth is in the low single digits (topping $60B next year), but annual EPS growth is around the 10%-11% range. Management has been shareholder friendly via a nice 3% dividend yield and buying back more than $10B in stock over the last 5 years.

Unusual Options Activity

On August 26th, the UPS Oct 16 $100/$105 bull call spread was put on 10,000 times for a $1.00 debit. This was tied to 150,000 shares of stock. Also, there was sizable opening selling in the Sep 18 $87 and $87.50 puts (2,500+ total traded).

United Parcel Service Options Trade Idea

Buy the Oct 2 weekly $96.50/$102 bull call spread for a $2.40 debit or better

(Buy the Oct 16 $97.50 call and sell the Oct 16 $105 call, all in one trade)

Stop loss- $0.95

1st upside target- $3.50

2nd upside target- $5.40

Follow Mitchell Warren (@MitchellKWarren) on Twitter for more stock and option market commentary.