Trading in markets like these can be very challenging.

Quite frankly, the rules do apply.

These markets do not care where the 200-day moving average is offering support or resistance, what the MACD is, the fact that all of your RSIs and Bollinger Bands are blown out. Technicals respect ordered markets. Panic is the antithesis of order. So, how do we trade? If you are scalping, many of your approaches will still apply. Most traders, especially options traders are not scalpers. There are still many approaches that can work for you.

Here’s one. Make a wish list for yourself; a list of stocks that you would love to own at a discount. Like a kid in a candy store. I don’t know how many stocks over the past year I have passed on because I was unwilling to close my eyes and hit “buy” time after time when it makes new all-time highs.

For me this list would be things like: NFLX, MS, SBUX, NKE, GS and FB, just to name a few. What else is typically true of these quick retracements? Implied volatility is high. How to take advantage of comparatively low prices and relatively high implied volatility? Credit spreads! One approach we like to use is a delta biased iron condor. This involves selling two verticals, both out of the money. One is a put vertical and one is a call vertical. In this case where you are trying to take advantage of a bullish bias, the short put spread will be closer to the money (longer delta) than the call vertical. For example look at Goldman Sachs (GS):

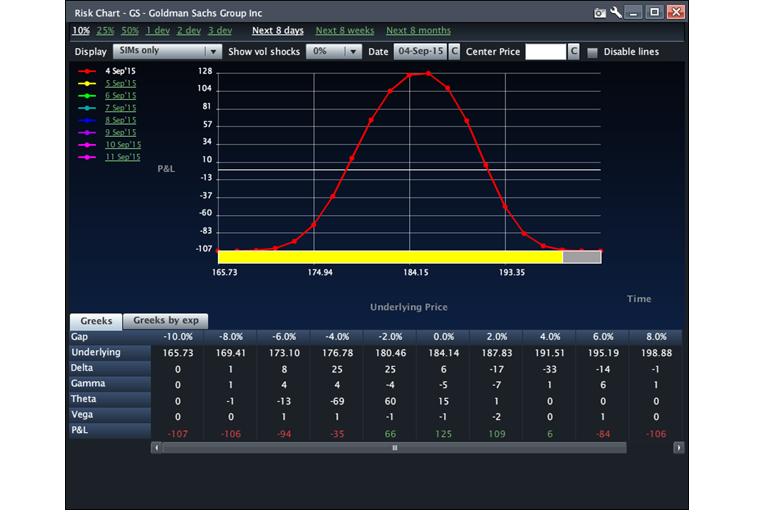

Other than the all out panic on 8/24, we see that GS really could not get much below $180. That could be our line in the sand and we could sell the 177.5/180 put spread expiring on 9/4and to enhance our premium intake we can sell the 190/192.5 call spread. If we did this for an expiration date of 9/4, the risk graph looks like this:

This chart shows that we have positive delta and negative vega which in our best case scenario is in our favor. The best place to be at expiration is above $180 and below $190. We can sell this spread for $1.40. Our max risk is the distance between strikes less the premium taken in which is $2.5 – $1.40 = $1.10. Our max return is simply the premium we take in for a risk/reward ratio of us laying odds of 1.27:1!