Volume Profile shows the historical price levels at which buyers and sellers transacted business in a particular stock or ETF. In the long-run, the amount of volume at various price levels tends to be significant. In the short run, anything can happen.

In reviewing the long-term volume profile for AAPL recently, I noted the large unfilled gap around $76. The problem for owners of AAPL is that the largest volume in the stock also occurred at that level, so it becomes a price magnet. I don’t know when price will get there, but I’d bet real money that it eventually does.

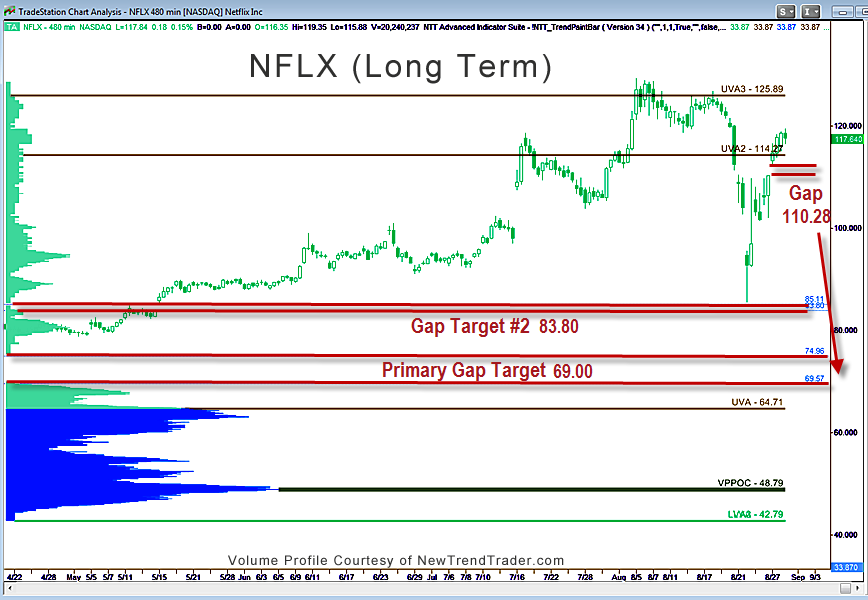

I hate to say it, but Netflix (NFLX) has a similar problem. While I admire Apple as a company, I love Netflix. Indeed, NFLX is universally loved and for good reason. The company has lowered the cost of movie viewing by an order of magnitude, and it has done so with a commercial-free model. It absolutely owns my living room.

But the Volume Profile is extremely precarious. It’s trading on fumes. Technically, the stock has risk to the large unfilled gap around $69. Only about 8% of the float is short, which means there are relatively few NFLX bears. The trailing P/E ratio of 263 is another reason to be extremely cautious. In comparison, AAPL has a trailing P/E of 13.

If AAPL eventually falls from the market tree, NFLX will certainly implode.

If you would like to receive a primer on using Volume Profile, please click here.