The bulk of our analysis focuses on the Commodity Futures Trading Commission’s weekly Commitment of Traders report. This report tracks the large position holders in every market broken down by, managed money, hedgers, index traders and small speculators. There are many ways to slice and parse this data.

We’ve found most of the low hanging fruit can be plucked using a simple combination of commercial traders’ sentiment combined with their nominal position relative to historical context. The premise behind Cot Signals is to use the commercial traders actions within the markets to determine swing-trading opportunities based on the commercial traders’ sense of value within a given market. This week, we’ll explain why we aren’t jumping into the coffee futures market even though commercial traders purchased more than 18,000 contracts last week, the biggest one week move in more than 20 years!

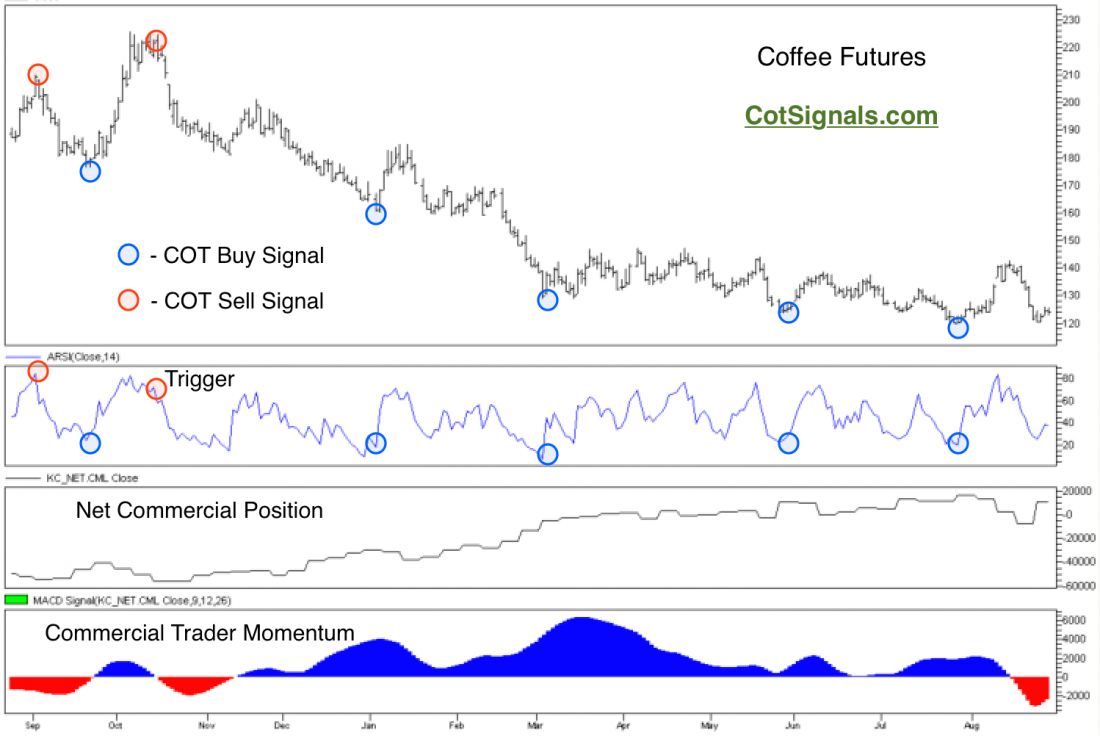

Diving into the chart below, I hope the first thing noticed is that commercial traders’ sentiment is negative as identified by the MACD of their net position in the bottom pane. Technically, if there were to be a trading signal this week in coffee, it would have to be a sell signal but I’m sure our regular readers already caught that. We only take trades inline with the commercial traders’ momentum. However, given my calculations, another week of net purchases will push their momentum back into positive territory. Therefore, we would like to see the market grind lower through the week and see commercial trader momentum shift into positive territory for next week’s trade.

It has been our experience that this is how the strongest reversals take place. This was exactly our premise behind last week’s crude oil trade. Furthermore, there is a growing imbalance between the market’s continued decline and the coffee futures’ fundamental data, which is beginning to suggest a smaller world harvest than anticipated. Much of this is being driven by the strongest El Nino effect in 20 years.

This has shifted weather patterns tremendously in the exotic crop markets like coffee, sugar and cocoa in Brazil, Columbia and Vietnam. We’ll update these three along with El Nino’s impact on global vegetable oil and rice production later this week. Suffice to say that coffee roasters believe the lowest coffee prices we’ve seen since last January won’t last for long. Once again, we’ll side with the collective research of the people that produce or refine the commodity coming out of the ground. Meanwhile, don’t be too quick to jump in this market’s decline.