You can pretend to trade in the theoretical world but at some point if you want actual money, you are going to have to trade in the actual world.

You have a lot of things to consider. Bid/ask spreads, volume, open interest and even regulatory issues. There is FINRA regulation out there known as “PDT Margin requirement”. PDT stands for “pattern day trader” and if you have less than $25,000 in your trading account, you should know this regulation. For the full text please refer to this link.

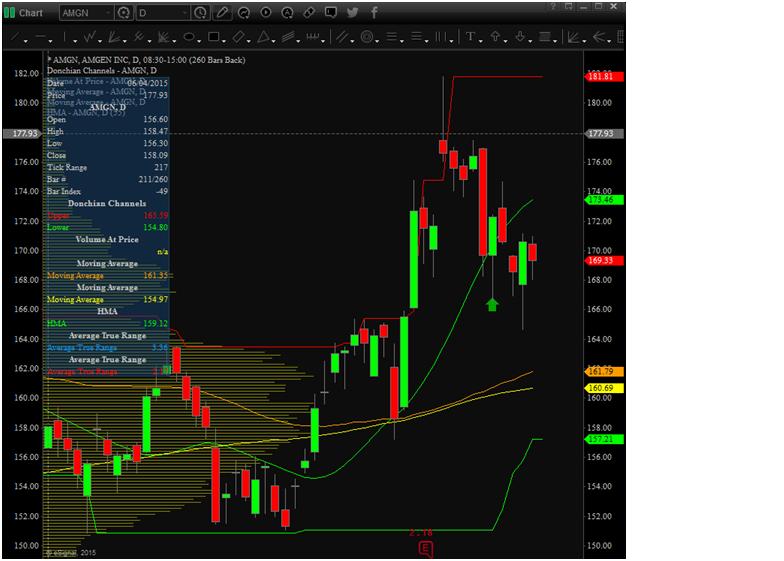

What is essentially means is that if you perform 4 “day trades” in five days you are subject to the constraints of this regulation. What is important to note as an options trader who employs spreads, getting into and out of a vertical spread counts as two “day trades”. So, if in a trading week you day trade a spread just twice you risk having your account locked up. It doesn’t even matter if the trade is a winner or a loser. So, what to do? Let’s take a look at how we approached our signal in AMGN earlier in the week. Here’s the price chart for AMGN:

Our entry signal on 8/6 was:

8-7-15: Based on our methodology a signal has been generated:

Buy (opening) the AMGN August 28th weekly expiration 172.5 strike call

Sell (opening) the AMGN August 28th weekly expiration 177.5 strike call

For a debit of $1.05 or lower.

This signal is not GTC and is valid with AMGN trading $165.50 or higher.

You can see our entry at the green arrow.

We bought the spread when AMGN was trading $167.10 (near the lows). AMGN took off. That’s great! The spread that we got in for $1.05 was trading $1.70 later that day! But we did not put out an exit signal. Why? We know that many of our students trade accounts with values lower than $25k and trading out of this spread could potentially put them at risk of being designated a PDT. So, instead we put out the following signal:

8-7-15: Based on our methodology a signal has been generated ONLY IF YOU ARE ALREADY IN THE AMGN SIGNAL FROM THIS MORNING:

Sell (opening) the AMGN August 28th weekly expiration 177.5 strike call

Buy (opening) the AMGN August 28th weekly expiration 182. 5 strike call

For a CREDIT of $.85 – $.90.

This signal is GTC IF AND ONLY IF YOU ARE ALREADY IN THE EARLIER AMGN SIGNAL.

We adjusted our position to now have on the 172.5/177.5/182.5 butterfly on for effectively $0.20 ($1.05 – $0.85). The market at the time was 0.70 bid at 0.90 so we already had 0.50 profit in the trade and eventually exited the trade at $0.90. This is a way for a smaller retail trader to lock in some potential profits while avoiding PDT designation.