For the past few weeks there’s been a consistently profitable trade in the S&P500 mini-futures (ES): buy the contract at midnight, and sell it at 4:00 a.m. The reasoning is easily understood. The futures are goosed when the US and European markets are closed and the volume is extremely low. But as soon as the big players come back to work, the artificially inflated values in the futures fall back to earth.

It happened again Tuesday night, early Wednesday morning. The ES ran up 20 points in overnight trading and opened Wednesday with a large gap. But that was as far it could go. The price faded all day; by the close the ES not only lost all the gains made overnight, also it lost everything it gained in the prior day.

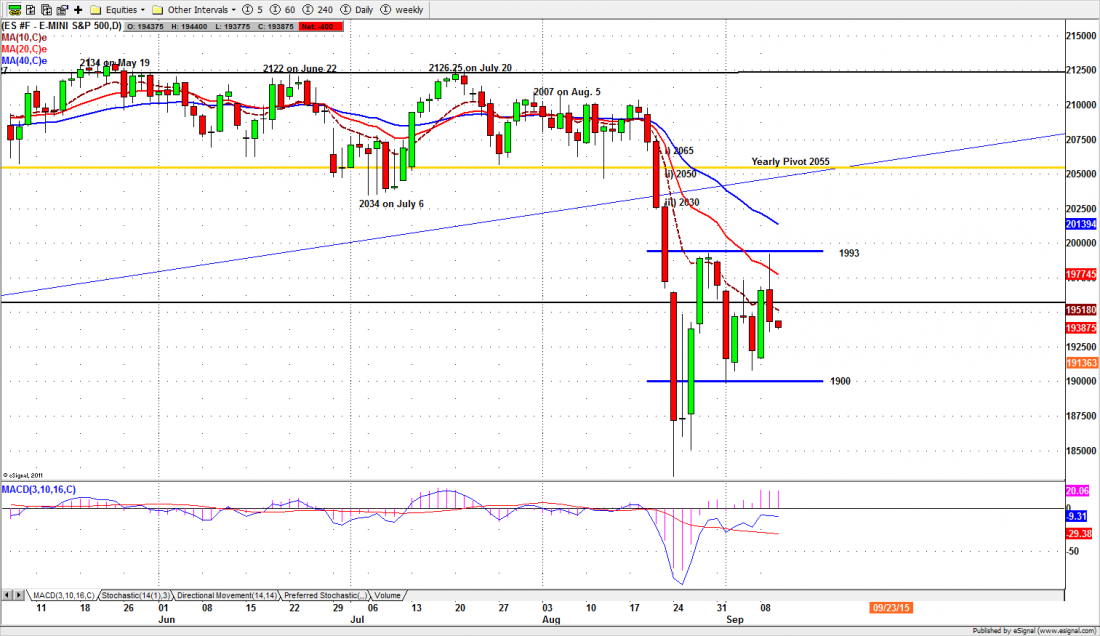

It closed below Tuesday’s low, and 25 points below the prior close. Yesterday’s Brave New Hope is today’s sucker rally, as we said it was. The Bears are back in force, and they have now defined the top of the new trading range at around 1992. We’re still looking for the bottom.

Thursday

The ES lost control of the 10-day moving average line again, and aggressive trend traders are back in on the selling side. Today ES may have a continuation low movement that could push the price back down to the low range at 1910-1900 for testing.

Thursday is rollover day. The September contract (ESU5) will expire next week and the December contract (ESZ5) will be the front contract to trade starting tomorrow. Expect lots of volatility seen today.

The low made today or tomorrow is likely to be the low for next week. 1935 will be today’s battle line for the options expiring tomorrow. If/when the ES price moves up toward 1975, we should see the sellers coming in; if/when the price drops toward 1900-1885, we should see the buyers enter.

Major support levels for Thursday: 1900-03.50, 1975-80, 1850-45, 1828.50-25;

major resistance levels: 1992.75-95.50, 2012.50-2013.50 2032-2035

For more detailed market analysis from Naturus.com, free of charge, follow this link

Chart: S&P500 mini futures (ESU5) daily chart Sept. 9, 2015