The copper market is typically referred to as the PhD of the metal markets because of its use as a forward indicator of industrial activity. Copper is used in everything from the smallest and cheapest of electronic throwaway gadgets to every new skyscraper. Therefore, regardless of the source of the demand in the copper market it always equals economic activity in some facet of a production-based economy.

This is also why one of the biggest plays in recent years has been to hoard copper at ultra low interest rates in the hopes of being able to turn the inventory over at a large profit once economic demand picks up. This story has been wrong since the inception of Quantitative Easing and is likely to remain wrong beyond the scope of the short copper futures trade that is currently setting up.

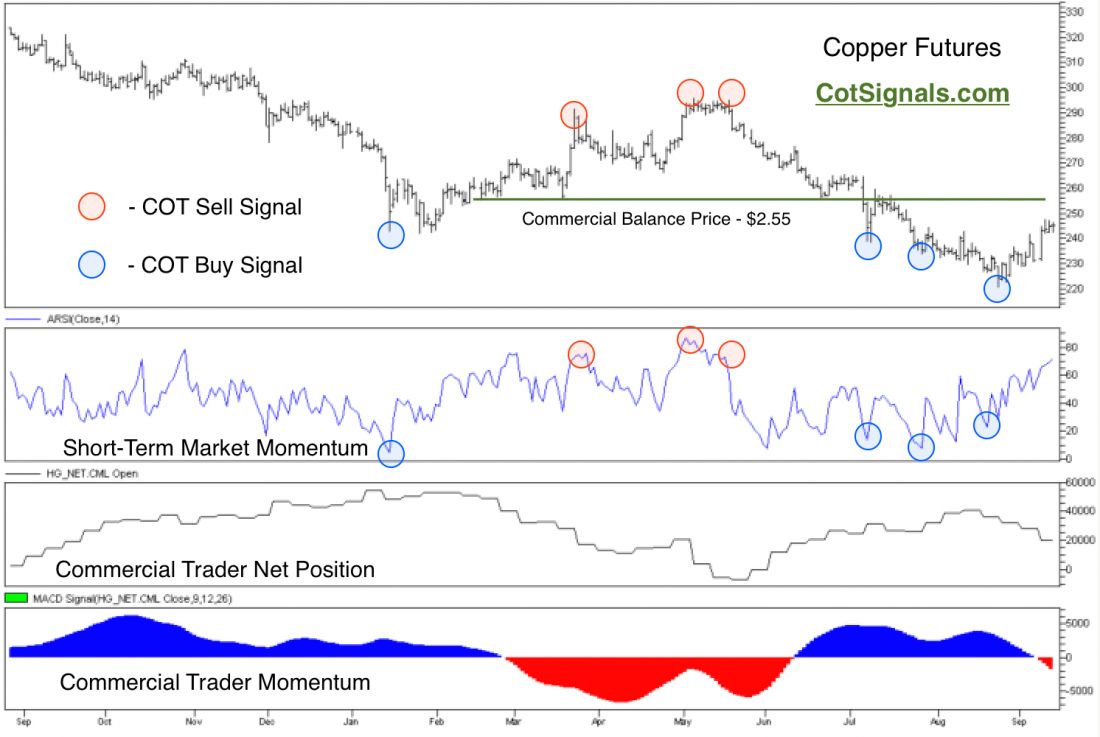

December copper futures made their recent bottom near $2.20 per pound on August 24th. The recent 11% rally off of the lows does not indicate that the copper market is anticipating forward economic growth. This is just a simple case of a bounce off the lows prior to a resumption of the larger downward trend. What makes us so sure? Two things. First, it’s tough take a market that has been in a downward trend since 2011 and call the bottom to the day. Secondly, commercial traders turned negative on this rally nearly instantly. Commercial traders in the copper market have built up a market balance price around $2.55 per pound. They were buyers coming down to that price from May through August and now, they’re unloading those purchases as quickly as possible on our way back to $2.55. These are the market swings and meanderings that apply especially well to our adaptation of the Commitment of Traders data.

Commercial traders have been net sellers for four straight weeks. They’ve sold more than 20,000 contracts and their selling has intensified as the market has attempted to climb with nearly 10,000 contracts sold just last week. This market currently fits our criteria for a short trade waiting to happen. Commercial traders are negative and we want to trade on the same side as their momentum. The recent rally has run us into overbought territory on our short-term market momentum indicator. All we need now is a little weakness to drop us back below overbought to create the COT sell signal. We’ll stay abreast of this situation, as the global fundamentals don’t justify a new upward trend in the copper market, which makes this an even better short selling opportunity. As always, once the market turns, we’ll be placing a protective buy stop at whatever this swing high turns out to be.