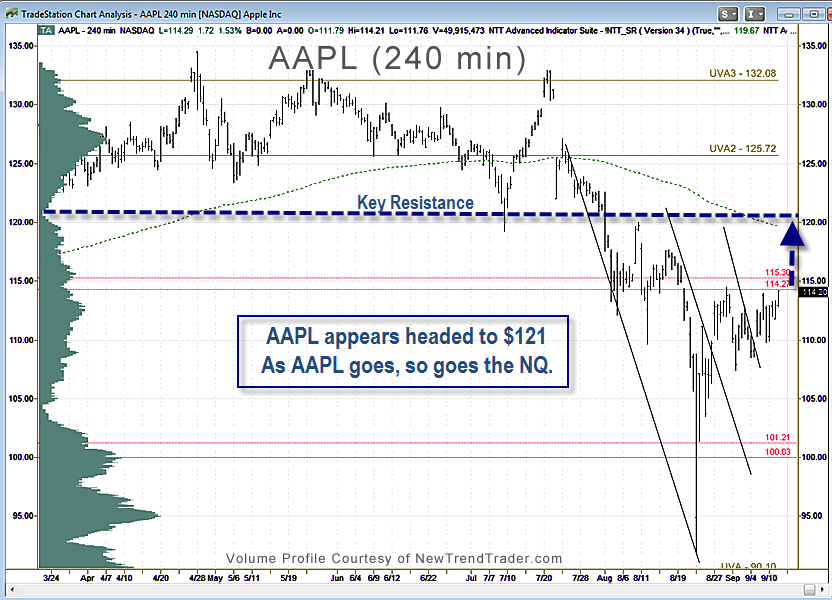

Since its bungee jump down toward $90 on 8/24, shares of AAPL have rejected several opportunities to retest that dramatic low. At the same time, the buzz from a slew of new product upgrades last week for the iPad and iPhone, including a new program enabling the purchase of unlocked phones on an installment plan that is equivalent to a rolling lease, failed to catalyze much upside.

The Apple limbo, however, appears ready to resolve to the upside.

The proximal target is the Low Volume Node just above the 200-day ema at $121. This is indicated on the chart by the dashed blue line. For Apple swing traders, that is the zone to take profits.

The rally in AAPL should move the entire market significantly higher this week.

If you would like to receive a primer on using Volume Profile, please click here.