For nearly a month, the IPO market has been dormant as the sell-off and volatility in the stock market has kept a lid on new deals. Additionally, the end of August and beginning of September is traditionally a slower period for the IPO market (and a busier time for vacations) due to the Labor Day weekend.

But, after the prolonged silence, the IPO market is finally set to make a little noise this week with three health-care related deals expected to price. The fact that it will be the healthcare industry breaking the ice comes as no surprise as nearly 40% of all IPOs over the past twelve months have come from this field. Additionally, eight of the top ten performing IPOs of 2015 have been healthcare related IPOs, including Global Blood Therapeutics (GBT, +167%), Seres Therapeutics (MCRB, +160%), Inotek Pharmaceuticals (ITEK, +143%), and Spark Therapeutics (ONCE, +95%).

The three IPOs expected to price this week are REGENXBIO (RGNX), Penumbra (PEN), and Nabriva Therapeutics (NBRV). In today’s article, we take a closer look at the first two, RGNX and PEN.

REGENXBIO (RGNX): Biotech With Tier One Underwriters Behind it Set to Debut On September 17

REGENXBIO (RGNX) is expected to price its’ 5.6 million share IPO on September 16 and open for trading the following morning. The deal is now expected to price at $22, which is up from the prior expected range of $17-$19. The lead managers on the IPO are Morgan Stanley, BofA Merrill Lynch, and Piper Jaffray.

The company is an early development-stage biotech focused on recombinant adeno-associated virus gene therapies. The company is developing gene therapy products administered directly into the body (“in vivo”) based on its NAV Technology Platform, which contains exclusive rights to over 100 novel AAV vectors. Their plan is to build internal gene therapy franchises in the metabolic, neurodegenerative, and retinal therapeutic areas.

Pipeline

RGNX has a full pipeline consisting of 23 product candidates aimed at treating a variety of diseases. This pipeline includes 5 internally-developed product candidates and 18 partnered product candidates. The company’s most advanced internally-developed candidates include programs for the treatment of two severe, rare genetic diseases: RGX-501 for the treatment of homozygous familial hypercholesterolemia (HoFH), and RGX-111 for the treatment of Mucopolysaccharidosis Type I (MPS I). RGNX expects these programs to enter Phase I/II clinical trials in the first half of 2016.

RGX-501 uses the AAV8 vector to deliver the human low-density lipoprotein receptor (LDLR) gene to liver cells. HoFH is a monogenic disorder caused by abnormalities in the function or expression of the LDLR gene. HoFH patients have very low levels or are completely deficient of LDLR, resulting in very high total blood cholesterol levels. This leads to premature and aggressive plaque buildup, life threatening coronary artery disease and aortic valve disease.

The current standard of care for HoFH focuses on early initiation of aggressive treatment because of the severe clinical effects of elevated LDLR, however, available treatment options are limited or insufficient. With RGNX’s development partners at Penn, it intends to file an IND in the second half of 2015 to support the initiation of a dose-escalation Phase I/II clinical trial of intravenously administered RGX-501 in the United States in patients with HoFH beginning in the first half of 2016. RGNX has received orphan drug product designation from the United States Food and Drug Administration for RGX-501.

It also has a program for wet age-related macular degeneration (wet AMD) that is in the preclinical stage and for which it expects to file an Investigational New Drug application (IND) in the second half of 2016. RGNX plans to build internal gene therapy franchises in the metabolic, neurodegenerative and retinal therapeutic areas, and develop multiple product candidates in these and other areas.

Financials

While RGNX is far from having any commercialized products, it does derive license and grant revenue. The company reported $6.1 million in revenue for both 2013 and 2014, and reported $2.0 million in revenue for 1H15. Not surprisingly, as a development-stage company, RGNX has reported substantial losses for those periods. Following the offering, RGNX expects to have $175 million in cash, which they expect will be sufficient to fund operations through 2017.

Penumbra (PEN): Medical Device Supplier With Strong Double-Digit Revenue Growth to Go Public on September 18

Penumbra (PEN) is expected to price its’ 3.8 million share IPO on September 17 and open for trading the following morning. The deal is expected to price within a range of $25-$28 and the lead underwriters on the deal are JP Morgan and BofA Merrill Lynch.

Penumbra (PEN) is a supplier of medical devices. It has a broad portfolio of products that address challenging medical conditions across two major markets: neuro and peripheral vascular. The conditions that its’ products address include ischemic stroke and hemorrhagic stroke, which involve blockage or rupture of blood vessels in the brain, and various peripheral vascular conditions that can be treated through thrombectomy and embolization procedures, which involve the use of medical devices to remove or treat blockages or ruptures of blood vessels.

The company has long been an established company in the neuro market, and it recently expanded its business to include the peripheral vascular market. The company sells its products to hospitals, primarily through its own salesforce, but also through distributors in select international markets.

Its’ neuro products are used to treat patients with vascular disease and disorders in the brain, including patients with strokes caused by either vascular occlusion or rupture or weakening of the vessel walls. Its neuro products are generally catheter- based technologies that are administered by an interventional neuroradiologist, a neurosurgeon or an interventional neurologist. Penumbra’s peripheral products are used to treat patients with vascular disease in all vasculature other than that which exists in the brain or the heart, including the upper and lower extremities, kidneys, neck and lungs.

The company estimates that the market for its current neuro and peripheral vascular products in the US and Europe combined was approximately $1.3 billion in 2014. The worldwide incidence of all forms of stroke is 33 million per year and more than 200 million people globally live with peripheral artery disease. Penumbra believes the market for its products remains substantially under-penetrated today.

Financials

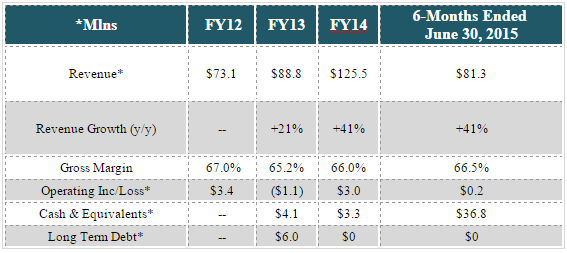

Taking a quick look at the financials, the company reported a profit in 2014, but recorded a small loss in 1H15. Revenue in 2014 grew by 41% to $125.5 million. In 1H15, revenue grew by 41% YoY to $81.3 million. PEN states that revenue growth was due to expansion of its salesforce headcount by 42.5%, further market penetration of its existing products, and sales of new products. Also, increased sales of Penumbra System products accounted for more than half of the revenue increase in the six months ended June 30, 2015.

Penumbra has thin margins, as 2014 operating margin came in at 2.4% versus a small operating loss in 2013. In 1H15, Penumbra reported operating margin of just 0.2% vs 4.1% in the prior year period. This was due to the fact that total operating expenses were up 51% year/year, outpacing its topline growth.

On the positive side, PEN’s balance sheet is in good shape. As of June 30, 2015, the company had no long term debt, and, if expected proceeds from its IPO are included, its cash balance would be $127 million.