The Federal Reserve Board’s decision to leave interest rates unchanged at 0% had the expected reaction of sending the Dollar and Treasury yields tumbling while sparking a rally in gold and silver. This kicks the can down the road to the October 26-27th meeting. In the mean time, the markets have reacted and there seems to be a clear disconnect between the general public’s trading endeavors and the commercial traders who are simply balancing risk and reward within their respective markets. To this end, it’s clear that silver miners believe $15.50 is an excellent price at which to sell forward production.

Silver’s multi-year downtrend began to flatten out late last year on the market’s first drop below $15 per ounce. Clearly, manufacturers saw this as a significant bargain, purchasing more than 40,000 contracts between July and October of 2014. Even though they were early, we can still see the value this price level represents as commercial end users of silver once again jumped in and bought 50,000 contracts between May and July of this year. Meanwhile, the silver futures have made neither a new high, nor a new low since September of 2014. Major commercial position changes within a sideways market are frequently indicative of long-term turning points. While I don’t believe we are there, yet this is something we’ll be keeping a macro eye on.

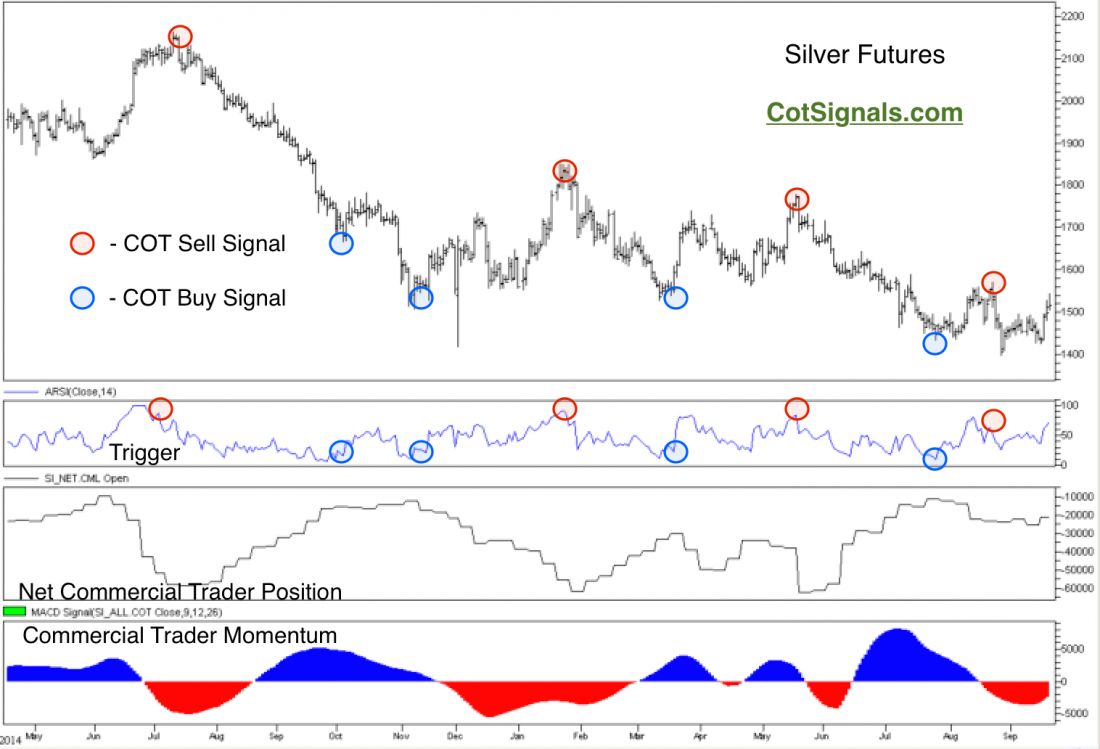

Looking at the chart below, you’ll see that in the short-term, we are bearish. Silver miners still have the upper hand as prices approach $15.50. Their selling intensified in late August as the market approached $15.50 and continued as they pressed the market to test the December low near $14. We view the recent action in the silver market as a knee jerk response fueled by speculative hopes that inflation will finally find its way into the precious metals. While this may be the case next year, we don’t believe we’re there. Thus, we’re selling December silver futures and placing a protective buy stop at Friday’s high of $15.435. We expect to see another run towards $14 and perhaps new lows before the end of the year.