SPX: The Fed is jawboning the market this week. We don’t buy it. Neither should you.

The price action in the S&P500 large-cap index last week was a textbook example of the power of words to move the market around. You’re going to get another example this week. Our advice: don’t fall for it.

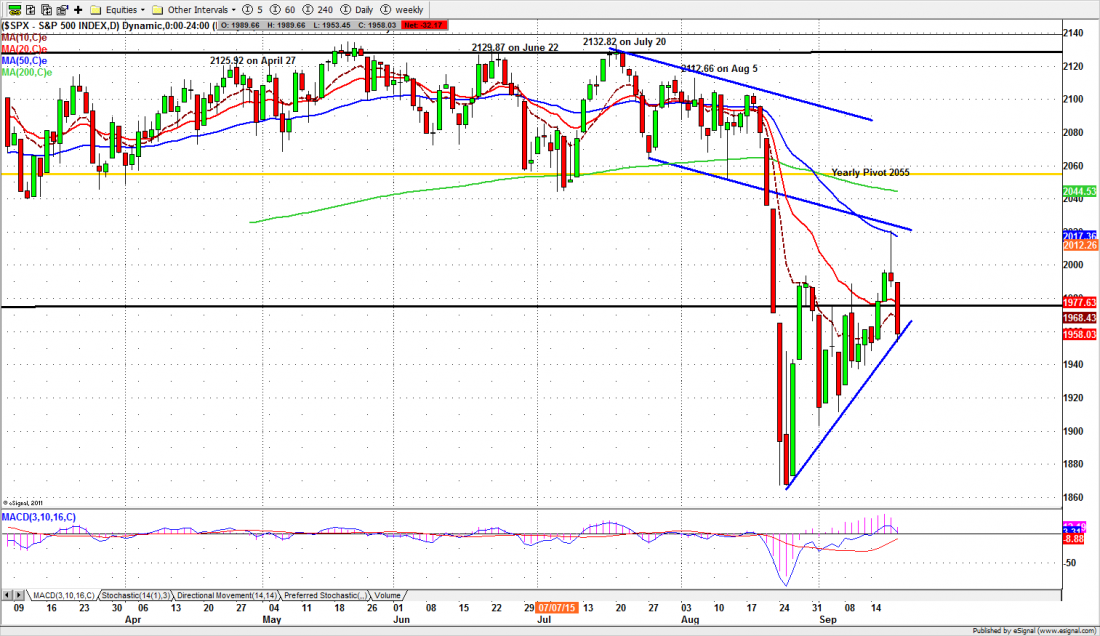

Last week the S&P500 (SPX) travelled up-and-down through 140 points from Monday to Friday – the equivalent of about 1400 points on the Dow – and closed at 1958.03, almost exactly where it started.

The reason for that rapid-fire round trip was the hype surrounding the Federal Reserve’s Open Market Committee meeting, which was supposedly considering an increase in interest rates.

In a classic case of “buy the rumor, sell the news” the market ran up 70 points – squeezing out all the shorts — right until the afternoon the Fed announced nothing is being changed. Then it dropped 70 points in the next day and a half – murdering all the longs – to end the week where it started. Maximum pain for everyone! What fun!

This week there will be some serious jawboning by Fed officials to prop this pig up a while longer. The Chair, Janet Yellen, has already told the world the economy is strong enough to consider a rate increase this year, which is surely a trap for the unwary. If the economy were strong, they would have raised the rates long ago.

She will be on the talk circuit this week, along with four, count them, four, and other Fed chairs to explain why they didn’t act now, but may act soon. If you read the financial media you will be seeing lots of stories this week about the Fed, and about who said what, and what it all means. Ignore it. It means nothing.

By delaying as long as they have, the Fed has pretty much made itself irrelevant. It may be able to accelerate the decline the market is going to experience in the next few weeks, and perhaps for the next year.

But they won’t be able to stop it.

This week

Lots of Fed-squawk, lots of economic data this week, but the important number to watch on the SPX is 1972. That was the support level that broke down in the first sharp decline. The SPX has not been able to make a weekly close above that broken support for the past three weeks. In other words, the Bulls have not been able to defend the gains they made on the relief rally from the August 24 crash. That – and the weak close last week – hints at worse to come. This ain’t over.

As long as the index doesn’t make a weekly close above 1972, the short-term and intermediate-term trend should be down. The index will continue to be volatile.

The support is around 1935-40. A break below 1930 could directly open a door toward 1900. The short-term indicators are bearish and the market is still overbought.

The futures (ESZ5)

Monday, the monthly pivot level (1965.50) will be first resistance line. As long as ES stays under it, the price should continue to decline and head toward the 1900 level area to search for very short-term support, especially if the price can break through 1927 and run the stops below that level.

Last Friday’s unfilled gap at 1977.25 is very important for the short-term decline. It needs to remain unfilled in the coming weeks to encourage the sellers to push ES to retest the August low (1831). Traders should focus on the short side on any bounce into the 1972-1965 zone.

Major support levels for Monday: 1932-35, 1922-18.50, 1907-03, 1875-50;

major resistance levels: 2015-18.50, 2029-28.50, 2035-38

For more detailed market analysis from Naturus.com, free of charge, follow this link

Chart: S&P500 cash index ($SPX) daily chart Sept. 18, 2015