Is the stock market going to go down again or should you be buying it here?

Are we at a point of great opportunity or a point of great risk?

These are million dollar questions. Billion dollar questions depending on your assets under management. Here’s my analysis and my currently favored scenario looking ahead.

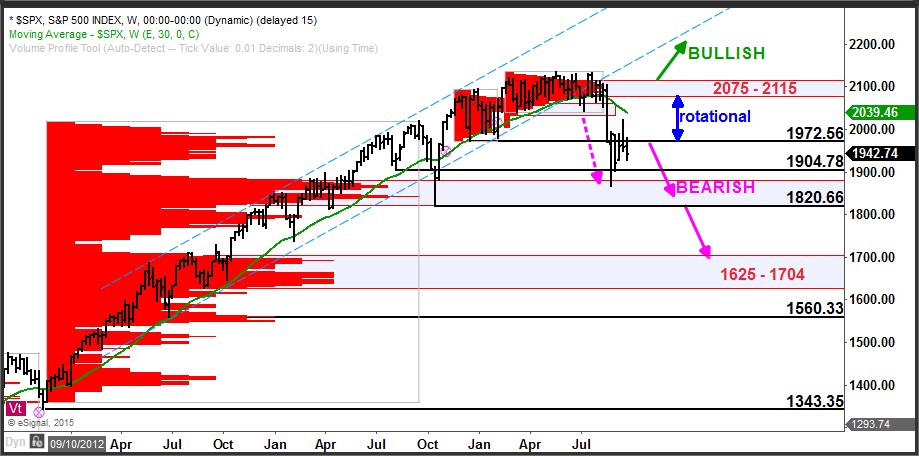

The S&P 500 remains in a bearish phase and is positioned such that I expect additional downside dead ahead. From a big picture perspective, there is no reason to be bullish while the index is below the robust zone of resistance at 2075 – 2115 that was built over the first half of this year.

My current expectation is for the index to return to the support zone at 1820 – 1880 (where the October 2014 low and more recent August low registered). I expect this support zone to be breached and to see lower lows.

If and when the index reaches the next major zone of support as defined by the volume-at-price profile at 1625 – 1704, then I will turn bullish for what I would anticipate to be a sharp and steep rally. The move into and out of this lower zone of support could prove to be a volatile move. For this reason, I would expect that only traders who are anticipating the potential of such a move (and that have planned ahead for it) are likely to participate in what could be the best buying opportunity this year.

Why would I say that such a scenario would potentially be the best buying opportunity of 2015?

Consider that a move from 1700 back to resistance at 2075 would be a move of +22%.

I will close with this caveat. This is my anticipation based on thinking 2 and 3 moves ahead. If the first or second moves fail to manifest, obviously the third move is off the table. That said, it always pays to be prepared.

If you’d like to learn more about how to read the market using volume at price information, click here. http://www.volumeatprice.com