The silver market has done its job perfectly during the last two years by frustrating as many market participants as possible. Approaching this market with a trader’s mindset will be essential during the remainder of the year.

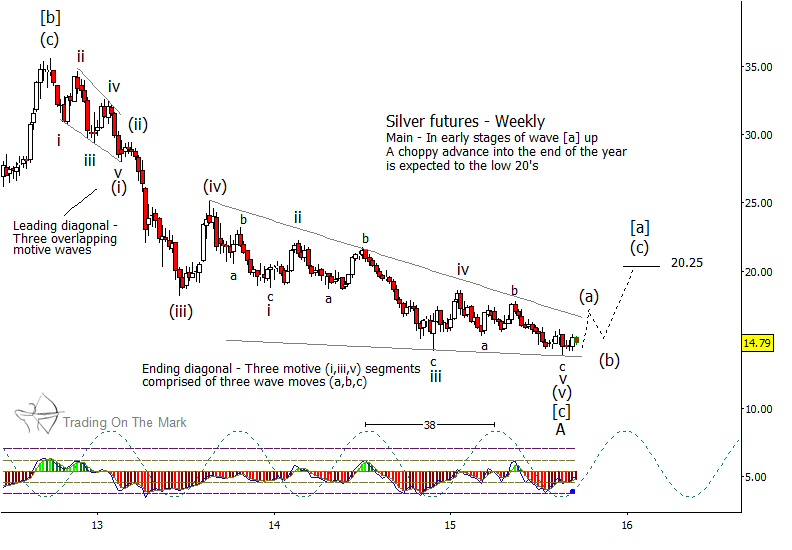

The difficulties (and the opportunities) arise because silver appears to have made only an intermittent low. With the completion of the large ending-diagonal pattern shown in the weekly chart, and with the completion of the even larger downward wave “A”, the next big move should be a sideways upward one. In coming months, we expect silver prices to make a choppy rise into the first major Gann target area near 20.25.

On a weekly time frame, confirmation that the ending-diagonal pattern is complete will be a breakout above the upper trend line shown. Even after price reaches that goal, we expect a great deal of back-and-forth action. Since we are now in a corrective market, attempting a breakout trade beyond the upper trend line is risky. A better approach will involve trying for “base hits” from intermediate support levels.

The dominant price cycle of 38 weeks suggests that traders should watch for the next intermittent high to occur near the end of 2015 or early 2016. That price/time area might cap the first stage – wave [a] of a larger [a]-[b]-[c] correction.

At that point, traders might watch for another reversal that should come in the form of a sizeable downward wave [b], which might again approach the trend line that connects the price lows of late 2014 and August 2015. In fact, wave [b] could even reach below the August low, although probably not by much. We might then expect another rise into late 2016, but it is still too early to map out a corrective path with any precision.

To provide context for the expected moves in silver, we have posted some bigger-picture charts here.