As we saw post Fed meeting, the markets didn’t take too kindly to standing pat on interest rates. In fact, after hustling up toward 2020 on the SPX in about 20 minutes, the selling commenced, and through last Friday it was about about 65 SPX handles lower. That sort of response is quite telling about the future, but perhaps there was nothing that could have helped.

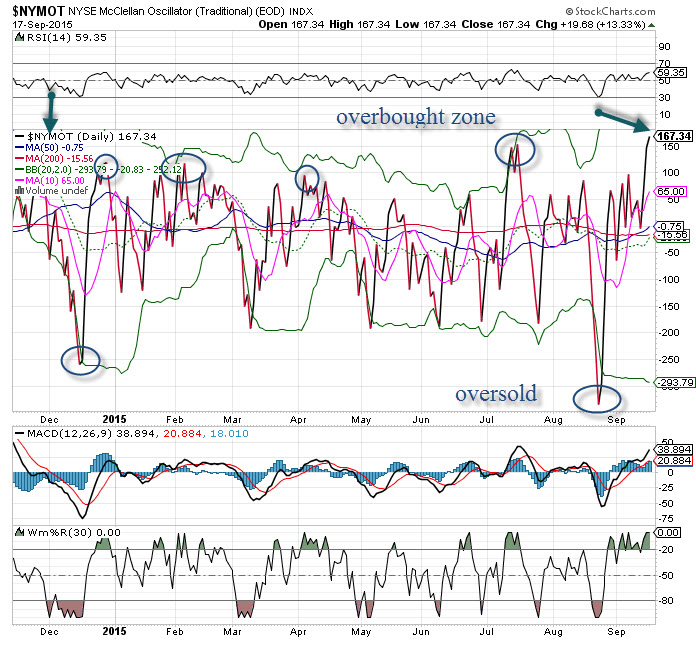

The McCllellan Oscillators were very overbought this week after the market surged for 3 out of 4 days. The bloated numbers were ripe for selling regardless of the decision, just a minor factor. As we see from the chart, when the oscillators get overbought that is a prime place to sell. So, it really didn’t seem to matter.

Yet, on a longer term basis the uncertainty and reliance on markets for the Fed didn’t change, and that is what is disturbing here. This was a moment to change their stance, there is some (but not much) inflation creeping into the system via prices and wage gains. Perhaps that is not sustainable, but then a generous monetary policy is really not needed here, either.

The longer this takes the less opportunity to disconnect monetary policy from financial markets. It seems the Fed is only listening to the markets and pleas from others now, which was okay just after the financial crisis but may not be right currently. The Fed needs to show some independence and give the markets some reality. Let it move on its own. We’ll see if it changes, but the Fed Funds Futures is now pricing in a rate hike out into 2016.