Here come Q3 earnings, all “better than expected.” Two companies hold the key.

The third quarter for 2015 ends on Wednesday, and sometime after that we’ll start getting earnings reports from the large cap companies that make up the S&P500. Once the results start trickling in there is an innocuous little phrase you should start listening for: “Better than expected.”

Don’t mistake that for good. The revenue numbers, with just a couple of exceptions, are likely to be lousy. But by announcing up front that their results are going to be really, really lousy, companies will be able to make their Q3 results look “better than expected.” They call this managing expectations, which is something different from managing the enterprises they run.

Then they’ll issue some low-rate bonds and use the proceeds to buy back their own stock, thereby both inflating executive compensation and making their earnings per share look better too.

The problem is that sooner or later lousy revenues, no matter how much lipstick you put on the pig, won’t keep the enterprise afloat. This year we’re likely to see serious declines in revenues, despite the best efforts at queasy accounting.

For the S&P500 as a whole, the analysts’ consensus for Q3 revenue is down 5% from the same period last year, following Q2 which was also down 5% y.o.y, and Q1, which was down 2%. The earnings per share for Q3 are also expected to decline by an estimated 4.5%, despite the buybacks.

Even more distressing is the reliance on a very few companies to make even those lousy numbers possible. Two companies, Apple and Bank of America, will account for the lion’s share of whatever poor growth there is.

In the Information and Technology sector, for example, earnings are expected to fall 0.4% in Q3; take Apple out of that sector, and the decline would be 5.9%. In the Financials, the estimated earnings growth for Q3 is a bit more than 8%; if Bank of America is excluded from the results, the year-over-year earnings growth would be 0.7%.

BOA had horrendous results in Q3 2014 – after writing off fines and litigation costs it booked a loss of $0.01 per share – so any improvement will have outsized effects. But if BOA has a sudden attack of rectitude and decides to make some minor change in accounting practices, say by marking to market its bond portfolio, then the S&P 500 is going to look like a disaster zone, no matter how much better than expected the numbers are.

Hang on to your wallet; this ain’t over yet.

Futures

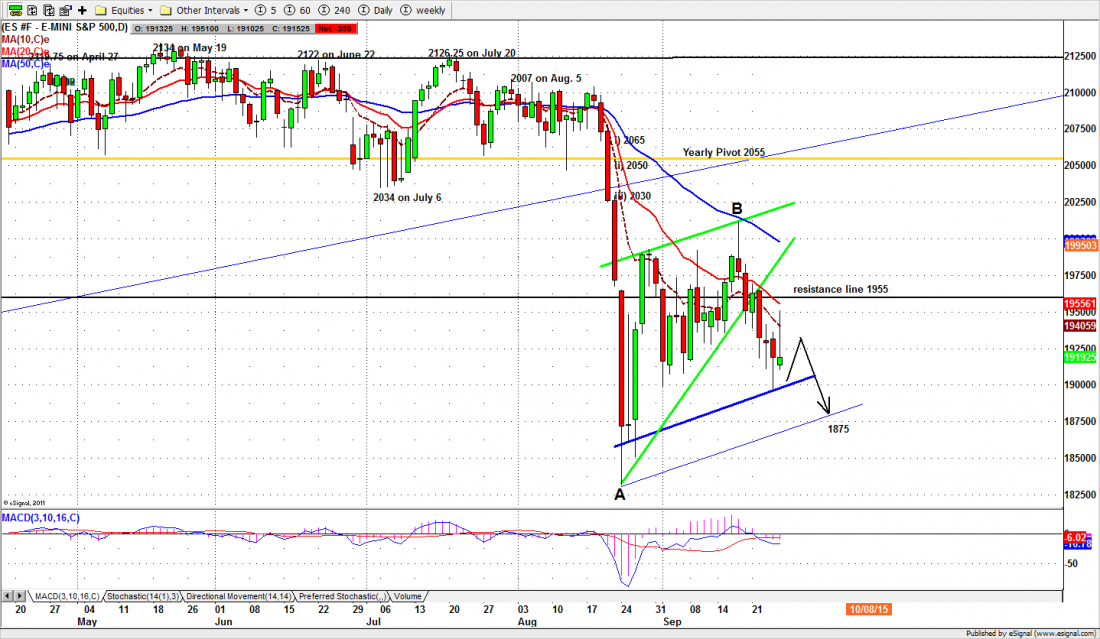

The S&P500 mini futures (ES) had a rough week, down 35 points in what is starting to look like a slow slide into a Bear market. Friday was particularly bearish and closed near the low of the weekly range.

That may result from the reluctance of players to hold positions over the weekend, but it may also indicate a growing consensus that the next move is down.

Today ES may bounce back up to the 1950 area for testing if 1910 holds up during overnight trading. As long as ES doesn’t go under 1897.25, a range bounce from 1900-1950 zone should be expected this week. A break below 1896 will be bearish, and a further decline toward 1875 will be likely seen. A move above 1939.50 should see some stops run and push the price back up to the 1944-50 zone. But the big sellers are waiting there.

Major support levels for Monday: 1907-03, 1875-50.50, 1850-45, 1831-25;

major resistance levels: 1975-85, 1993-95.50, 2015-18.50, 2029-28.50

For more detailed market analysis from Naturus.com, free of charge, follow this link

http://www.naturus.com/mailing-list-signup-page/

Chart: S&P500 mini futures (ESZ5) Sept. 25, 2015