GBP/USD may weaken as expectations grow for BOE to hike rates until mid-2016

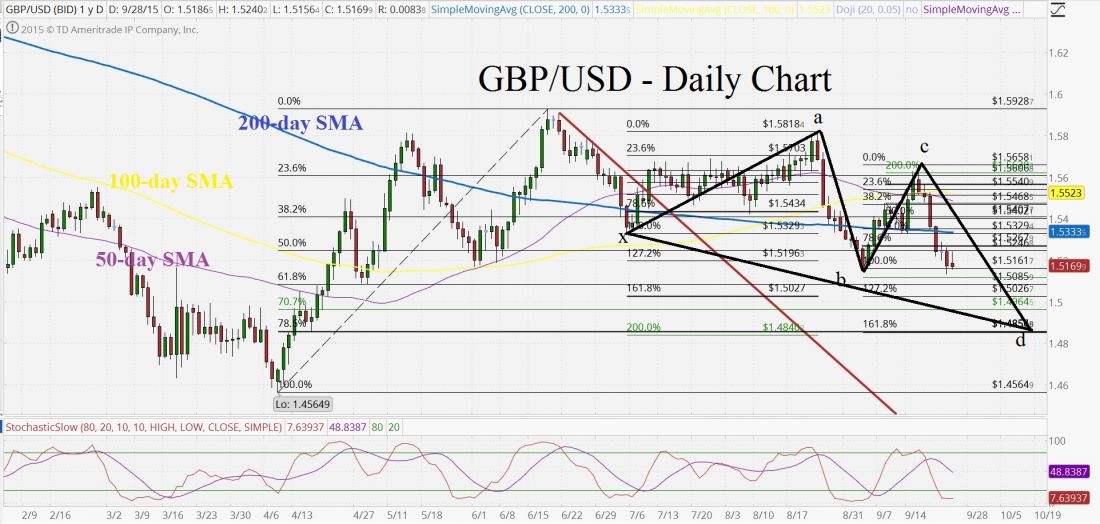

The British pound continues to trade below the 200-day SMA, but has tentatively found support from the 1.5150 area as downside momentum fades. The currency pair may remain weak as expectations are growing for the Bank of England to delay raising interest rates until mid-2016.

If data this week shows a significant decline with U.K. manufacturing growth in September, we could see price selloff towards the 1.50 handle. The forecast is currently at 51.3, but if we see the index from Markit Economics print below the 50.00 handle we could see downward momentum take the currency pair towards the 1.4850 level. It is around that area that we could see the formation of a bullish butterfly pattern. Point D of the bullish reversal pattern is targeted by both the 200.0% Fibonacci expansion level of the X to A leg and the 161.8% Fibonacci expansion level of the B to C move.

If the downward move for sterling does not continue, major resistance will come from the 200-day SMA, which currently trades at the 1.5330 area. A daily close above the 1.5550 could open the door for further momentum to target the 1.5800 region.

The trade: Sell GBP/USD at 1.5200 with a stop loss at 1.5250 and a take profit at 1.4900. The Risk/Reward Ratio is 1:6

Edward J. Moya

Chief Technical Strategist

WorldWideMarkets Online Trading