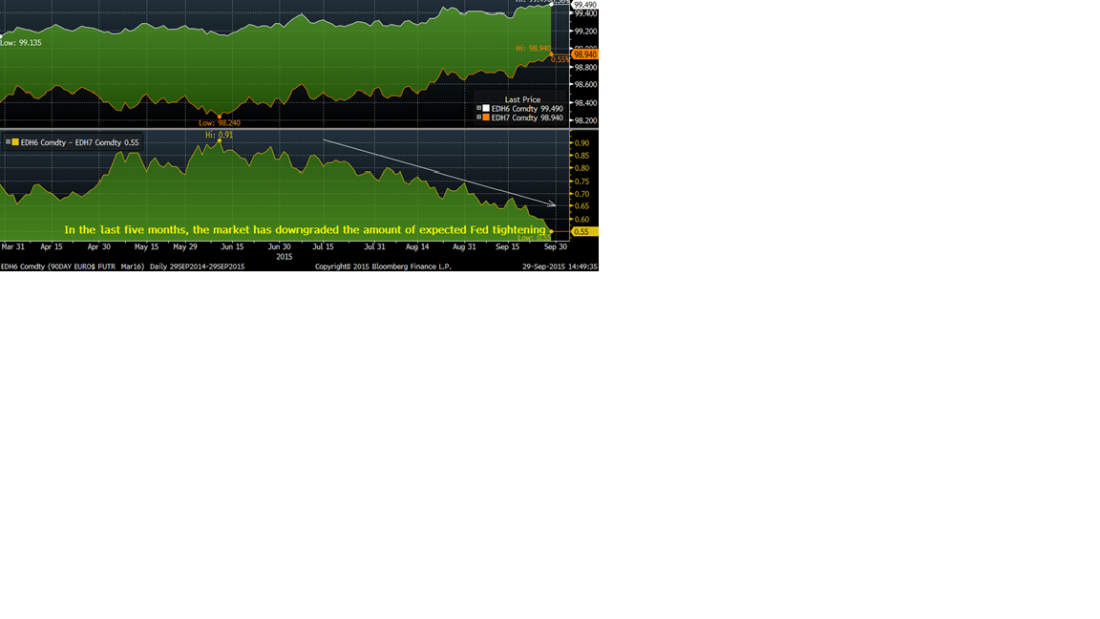

Current interest rate markets have some participants scratching their heads. I have often referred to Eurodollar one year calendar spreads as indicative of how much tightening the MARKET expects over a given year. The peak one-year spread has been EDH16 versus EDH17. As of Tuesday’s close, the two relative prices were 99.495 (or a yield of 50.5 bps) and 98.945 (a yield of 105.5 bps). So the spread settled at 55, a new low. Which means the over a year, the market is now expecting the Fed to perhaps tighten just twice (two 25 bp increments). As can be seen from the chart below, in May this spread was 90 bps. So in spite of all the blather about Fed rate hikes, the market has downgraded the amount of expected tightening, especially since strains in China and other emerging markets became more publicized.

Given that many Fed officials have said they don’t think there will be large ramifications from China’s problems, some market participants think these spreads have compressed too much. I’m not so sure; this is a powerful trend. But while calendar spreads continue to project a very gradual and cautious Fed, there have been other trades this week that are even more surprising. For example, there has been a buyer of 90,000 EDU6 100 calls for 0.5 bp. That’s north of a million dollars in premium outlay. In Eurodollars, the 100 strike price represents the ZERO PERCENT strike. In other words, three-month LIBOR would have to go to a negative interest rate for this trade to finish in the money.

Can it happen here? In Europe the three-month rate contracts already trade over 100, at negative yields. In the US, the only negative yield is in short term treasury bills, for example the one month bill trades at -1 bp.

The most likely explanation for the EDU6 100 call trade is that a market maker is trying to cap his upside risk. However, we also note that this trade came shortly after the last FOMC meeting, when one participant actually thought a Fed Fund target of -12.5 bps would be appropriate through the end of 2016. In any case, the US interest rate markets are reflecting deep concerns about forward economic growth and inflation prospects. The above are but two small examples.

The conclusion that I draw, and have warned of in previous posts, is that traders must continue to be cautious and pare risk profiles. Regardless of what the Fed says, the US is linked to the rest of the world. Let market signals provide evidence that the storm has passed. As of now, it’s still moving towards us.