The last day of September is a loser. Should you buy anyway?

October is one of the peculiarly dangerous months to speculate in stocks in. The other are July, January, September, April, November, May, March, June, December, August, and February.

— Mark Twain

Mark Twain was right, sort of. October, which starts tomorrow, is historically one of the worst months to trade stocks, but in the last 10 years has been profitable. September sucks. But we are moving into the market’s winter, and data going back 316 years demonstrates that the winter is generally profitable. The summer, by comparison, is a bummer.

And by some counts, today is the worst day of the year to be long equities. The S&P500 is down 62% of the time on September 30. The rest of the month is no bargain either. The 38th, 39th and 40th weeks of the year – all in September – are the worst of the year, going back to 1950.

The folk wisdom about seasonal effects in equities has been confirmed by a monumental study by Ben Jacobsen and Cherry Y. Zhang from Massey University (New Zealand) who tracked stock market gains and losses in 108 countries going back more than three centuries.

Their conclusion: every market, everywhere, is better in winter, defined as November 1 to April 30, than in summer, May 1 to October 30. It doesn’t work every year, but worldwide, over any reasonably long period of time, winter averages gains of 2.46 per cent or more; winter averages losses of 0.96 per cent.

If you want to look at a shorter period and just US markets, from 1999 to 2012 winter returned profits of 6.36 per cent; summer had losses of 1.27 per cent.

Is that enough to keep you out of the market until the end of October? It shouldn’t be. US equities in recent years have done better than average in October. But the absolutely best month to be long US equities is December. Santa really does come to town every year.

Today

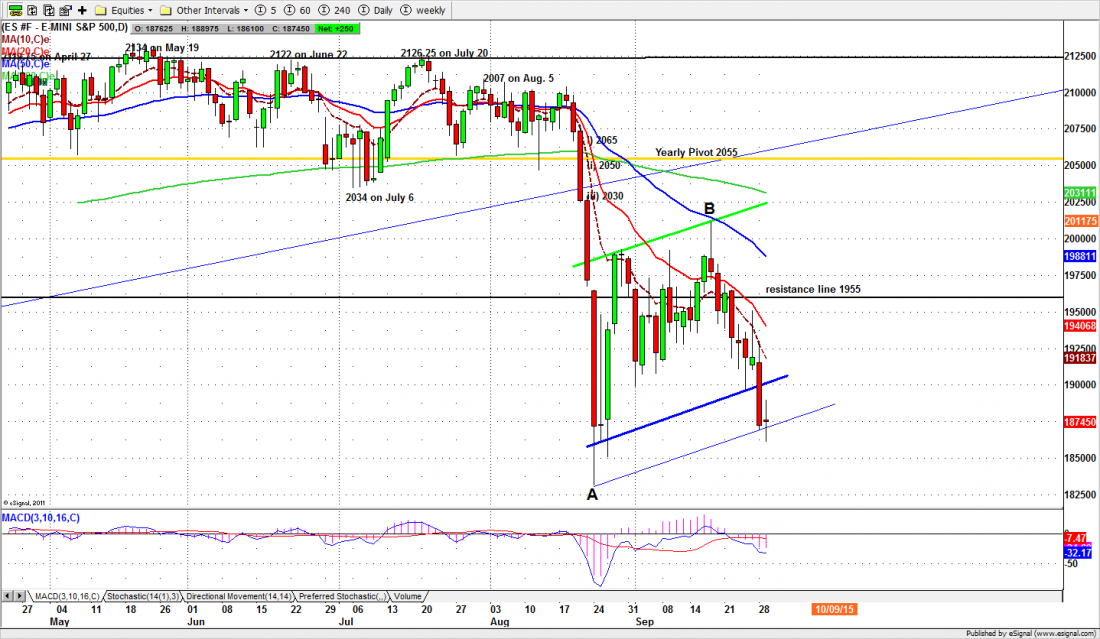

Despite the bad reputation of September 30th, a little bounce is possible today. The monthly options expire at the close this afternoon, and yesterday the S&P500 mini-futures (ES) spent the day battling around the 1875 line, which is a significant strike price for option players. The outcome was a doji that closed almost exactly where it opened, but traded through 28 points. Lots of action, no progress.

That indicates indecision about the next move. The Fed chair speaks at 2 pm and may try jawboning the market up. The Fed has been trying that all week without success, but it may work today. Or not.

There is a bearish A-B-C correction in play. But for the short term the market is heavily oversold and that may well result in an oversold bounce, perhaps up into the 1900-1915 zone. In the alternative the ES may just go sideways and mimic today’s range, with a close around 1875 … like today.

Just don’t confuse a bounce with a recovery. We’re still bearish for the immediate future.

Major support levels for Wednesday: 1850-45, 1830-25, 1800-06, 1775-85, 1750-55;

major resistance levels: 1931-28.50, 1945-55, 1998.75-95.50,

For more detailed market analysis from Naturus.com, free of charge, follow this link

http://www.naturus.com/mailing-list-signup-page/