But they are climbing.

Thursday was a strange day in the markets. The S&P500 mini futures (ES) rallied a little in overnight trading, pushed by comments from Fed leakers that a rate increase in 2015 is unlikely – something almost everybody in market had assumed weeks ago. Apparently saying it again is enough to rally the market overnight.

Then, in the regular session, the futures fell as New York Fed Chairman William Dudley noted that the Fed could raise rates even if “the data’ don’t dictate an increase. Panic selling.

Then at the stroke of noon the market started moving straight up. It bounced 35 points from the Dudley Decline – five consecutive green hourly candles with no hint of red anywhere – and closed at the top of the trading range. Panic buying.

What makes this strange is that none of the explanations offered by the various pundits makes any sense. The Fed has been shilly-shallying around without raising interest rates for seven years. Nobody expects them to raise in 2015, and if they screw their courage to the point they raise rates in 2016 – an election year – it will be a very modest affair.

The reality is that economic data varies from bad to somewhat less bad to horrifying. Real corporate earnings (never mind the adjusted net income figures) for this quarter are way down for some big players – see Walmart, for example – and the international economic and political situation should scare you.

And yet, at 12:00, somebody throws a switch and the futures rally 35 points, running all the stops and turning a slow dull day into an affirmation for the Bulls. It ain’t natural, and it ain’t gonna last.

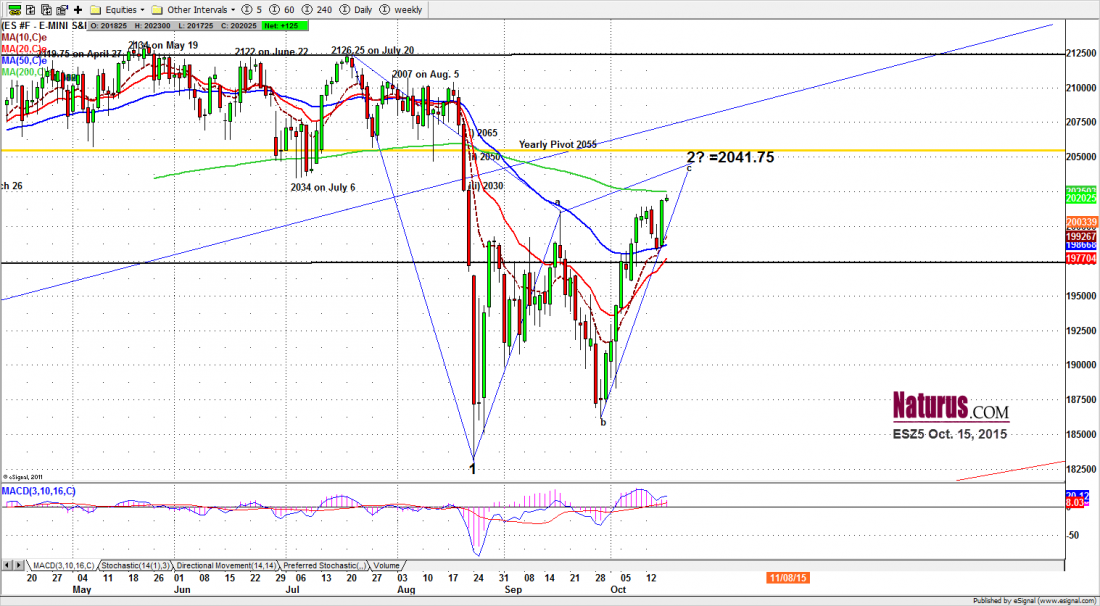

But while it does, we’d better take advantage of it. The futures closed at 2019.00, just 50 cents below the high of the day and 35 points above Wednesday’s close. The ES is now firmly above the psychologically import 2000 level, and comfortably higher than the 2014-15 resistance, which should now become support.

What we’ve seen is a brief, small, two-day pullback in a strongly rising market, a pullback which has now been expunged by a strong rally day. We’re suspicious, we’re worried, and the futures have been falling in early overnight trading. But we’re going along for the ride. While it lasts.

Today

The October index options settle today, at 9:45, and that may hold the ES in place in the early trading. After the settlement the price may fluctuate a bit more.

One important level today will be the 200-day moving average, currently around 2025-26. If the price moves above that level we could see a continuation rally up to 2033, to test the support zone that broke in the Aug. 24 crash.

If the price fails to break out, but instead falls below 1995, we may head back down to the recent Globex low around 1983-4

But before that happens – if it does — expect to see some buying on the dips if/when the ES drops near 1989-85.

Major support levels: 1928-29.50, 1900-03.75, 1880-75, 1850-45;

major resistance levels: 2025-32, 2042-40.50, 2050-46.50

For more detailed market analysis from Naturus.com, free of charge, follow this link

http://www.naturus.com/mailing-list-signup-page/