It was the summer of love for biotech. The moon in June shone brightly over the heady momo parade as one small cap wonder after another broke out to new highs after issuing just about any sort of quarterly report. Earnings, of course, were optional.

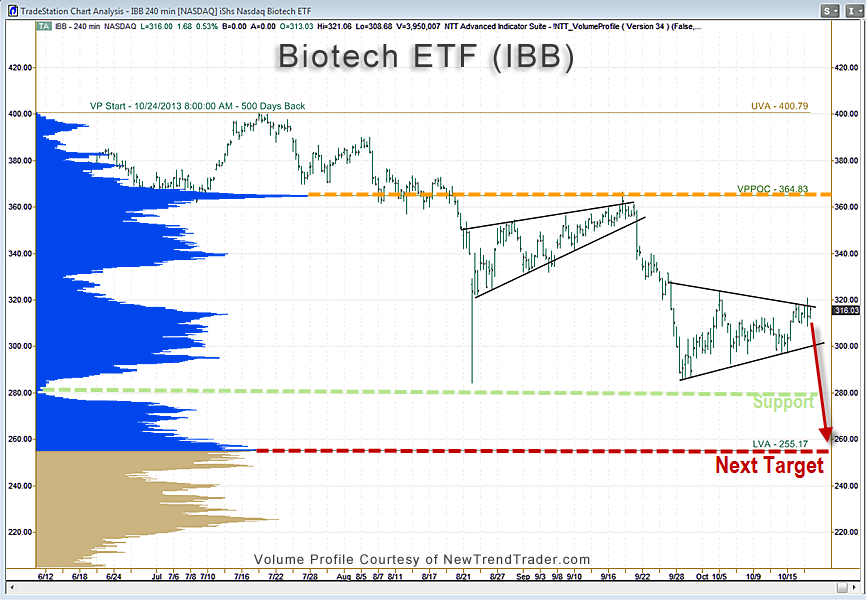

Nevertheless, I was a bit too cautious when I penned my Biotech article for Trader Planet on 8/4. I hesitated to “call the top,” but at least I did forecast downside targets at $364, $339 and $313. All three have been attained. Unfortunately for those friends of biotech, the Volume Profile chart accompanying this article suggests that the correction is not complete, even after a 25% haircut.

The Nasdaq Biotech ETF (IBB) is the volume leader in the biotech ETF space and I consider it representative of the sector overall. With IBB, one is investing mostly in industry leaders such as Gilead Sciences (8%), Biogen Idec (8%), Celgene 8%, Amgen (7.7%) and Regeneron (7%). And when it comes to valuation, (IBB) has a fairly reasonable trailing 12 month P/E ratio according to Yahoo Finance.

That said, I’m expecting a test of the Lower Value area around $255. There is a decent amount of volume in that general area, which should be sufficient to cushion Icarus’ fall.

If you would like to receive a primer on using Volume Profile, please click here: www.daytradingpsychology.com/contact